株式会社ネットプロテクションズ(所在地:東京都千代田区、代表取締役社長:柴田 紳、以下当社)と、株式会社山陰合同銀行(本社:島根県松江市、頭取:山崎 徹、以下ごうぎん)は、企業のDX推進に向けてビジネスマッチング業務を開始したことをお知らせします。

本日4月26日から「NP後払い」や「NP掛け払い」等の後払い決済サービスを活用した、お客様の業務効率化や地域のDXを共同で推進します。

ビジネスマッチング業務開始の背景・目的

昨今の社会をとりまく環境は、新型コロナウイルスの感染拡大による働き方の変化や仕入価格の上昇などが起き、ここ数年で大きく変容しています。一方で、地域の少子高齢化、人口減少は続いており、企業は課題解決のためにさらなるDX推進が求められる環境となりました。特に、ごうぎんが主な経営地盤としている山陰地域は、人口減少や少子高齢化が進んだ、いわゆる課題先進地域です。

この度、全員コンサルでお客様の課題を 現場で解決することを目指すごうぎんと、未回収リスク保証型の後払い決済サービスを通じて企業のDX支援を行う当社の意向が一致しビジネスマッチング業務を開始する運びとなりました。当社の後払い決済サービスを通して、企業の業務効率化および資金繰りの安定化を実現し、事業成⻑に貢献してまいります。

今後も強固なパートナーシップのもと、さらなる協業の可能性を検討します。

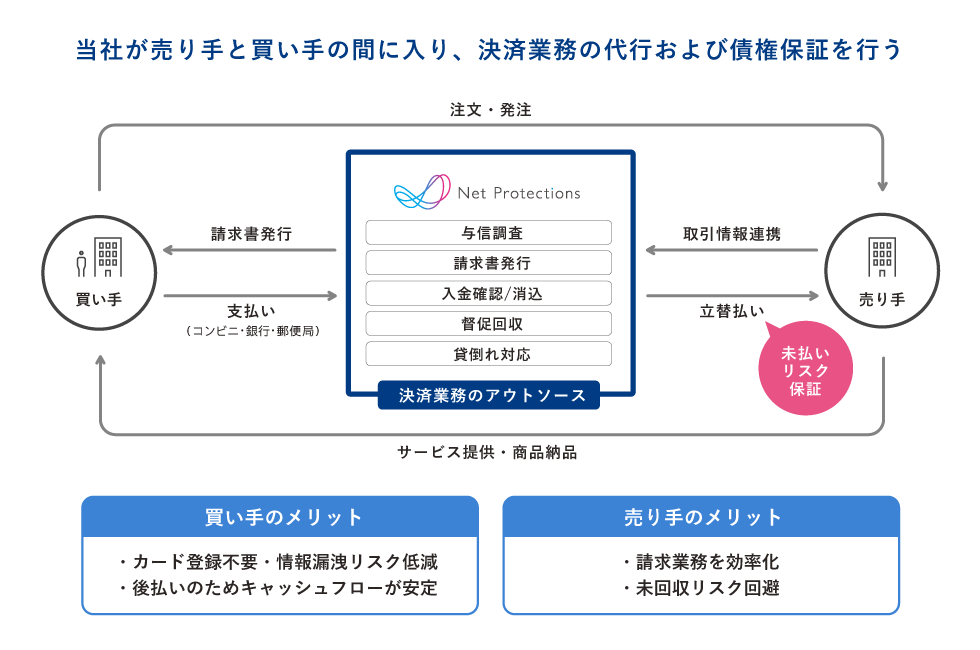

後払い決済サービス概要

株式会社山陰合同銀行 会社概要

【商号】

株式会社山陰合同銀行

【取締役頭取】

山崎 徹

【URL】

https://www.gogin.co.jp/

【事業内容】

・銀行業務

・リース業務

・その他関連事業

【創立】

1941年7月1日

【資本⾦】

207億円

【本店所在地】

島根県松江市魚町10番地

株式会社ネットプロテクションズ 会社概要

当社は国内BNPL決済サービスのパイオニアです。2002年より、日本で初めて未回収リスク保証型の後払い決済サービス「NP後払い」の提供を開始し、2022年3月までに年間ユニークユーザー数(※1)が1,500万人超に達し、累計取引件数が3.4億件を突破するまでに至りました。2011年より、同サービスにより培った独自の与信ノウハウとオペレーション力を企業間取引向けに展開した「NP掛け払い」の本格販売を開始し、2021年度の年間流通金額では前年比約30%の成長率で伸長しています。2017年には、EC物販だけでなくデジタルコンテンツ・実店舗など様々な業種で導入可能な後払い決済「atone(アトネ)」の提供を開始しました。さらに2018年には、台湾においてもスマホ後払い決済サービス「AFTEE(アフティー)」をリリースしました。当社はこれらの事業運営によって高い技術と豊富な実績に基づいた与信とオペレーションが構築されており、決済サービスを通じて誰もが安心かつスムーズに商取引できる社会の実現を目指しています。

【商号】

株式会社ネットプロテクションズ

(株式会社ネットプロテクションズホールディングス(東証プライム、証券コード7383)グループ)

【代表者】

代表取締役社長 柴田 紳

【URL】

https://corp.netprotections.com/

【事業内容】

後払い決済サービス「NP後払い」の運営

企業間決済サービス「NP掛け払い」の運営

訪問サービス向け後払い決済サービス「NP後払いair」の運営

新しいカードレス決済「atone(アトネ)」の運営

台湾 スマホ後払い決済「AFTEE(アフティー)」の運営

ポイントプログラムの運営

【創業】

2000年1月

【資本金】

1億円

【所在地】

〒102-0083 東京都千代田区麹町4丁目2-6 住友不動産麹町ファーストビル5階

※1)2021年4月1日~2022年3月31日における「NP後払い」の利用者のうち、氏名・電話番号の双方が一致する利用者。

本リリースに関するお問い合わせ

担当 :株式会社ネットプロテクションズ 広報

MAIL : pr@netprotections.co.jp