株式会社ネットプロテクションズ(所在地:東京都千代田区、代表取締役社長:柴田 紳、以下当社)は、国内環境に適合したShopify(ショッピファイ)アプリを提供する企業アライアンス「App Unity」(以下「App Unity」)に、アプリパートナーとして参画いたしました。

先般「NP後払い」「atone(アトネ)」がShopifyアプリストアに掲載され、Shopifyの公式アプリとなったことに続き、Shopify利用店舗の売上向上を新規獲得・リピート促進の両面から支援する動きをさらに加速していきます。

なお、当社では、現在、Shopify利用店舗向けの期間限定導入キャンペーンを実施中です。合わせてご確認ください。

「App Unity」とは

国内環境に適合したShopifyアプリを提供する企業アライアンスです。国内EC環境に適合した新規アプリの開発、目的別ソリューションパッケージの開発、Shopifyアプリのサポート体制の標準化、相互のアプリやテーマ間の干渉の調査および解消、Shopifyコミュニティへの積極的な情報提供などを行うことで、Shopifyを取り巻く国内環境の発展に寄与していきます。

詳細はこちら:https://appunity.jp/

「App Unity」参画の背景

当社は国内後払い決済サービスのパイオニアであるとともに、BtoC取引向け国内後払い決済サービス市場において40%以上のシェアを誇るリーディングカンパニーです。

EC業界全体の活性化・健全化についても役割を担うべき存在と自負していることから、Shopifyを利用しEC事業を展開するマーチャント(事業者)様の成長にも寄り添いたいと考えてきました。

先般、Shopifyの公式アプリとして、当社の後払い決済サービス「NP後払い」「atone」が公認されたことを端緒とし、Shopify利用店舗の売上向上を新規獲得・リピート促進の両面から支援する動きをさらに加速させるため、このたび、「App Unity」への加盟に踏み切りました。

今後は、Shopify向けアプリケーションを提供する各サービサー様と連携しながら、マーチャント(事業者)様を包括的に支援していきます。

ShopifyとNP後払い・atoneの連携について

決済は購買体験の出口であり、消費者ニーズに合わせた決済手段の拡充は、利用者の利便性向上だけでなく、EC事業者の新規ユーザー獲得や売上の向上にも繋がります。なかでも、国内市場において後払い決済の需要は高く、クレジットカードに次いで利用希望の多い(※1)決済となっています。代引を代替する決済としても広がりを見せ、オリジナルサイトでの初回購入ではクレジットカードを使いたくないというニーズにも答えます。

当社では、2022年4月よりShopifyとの連携を開始しており、Shopifyを利用するEC事業者様は、システム開発を行うことなく、簡単に「NP後払い」「atone」を導入することが可能です。

※1) ネットプロテクションズ調べ。2016年3月25日~26日、全国の 10 代~ 50 代の男女 2,065 人を対象にしたインターネットリサーチ

ネットプロテクションズの後払いの強み

高い与信力で、売上UPに確実に貢献

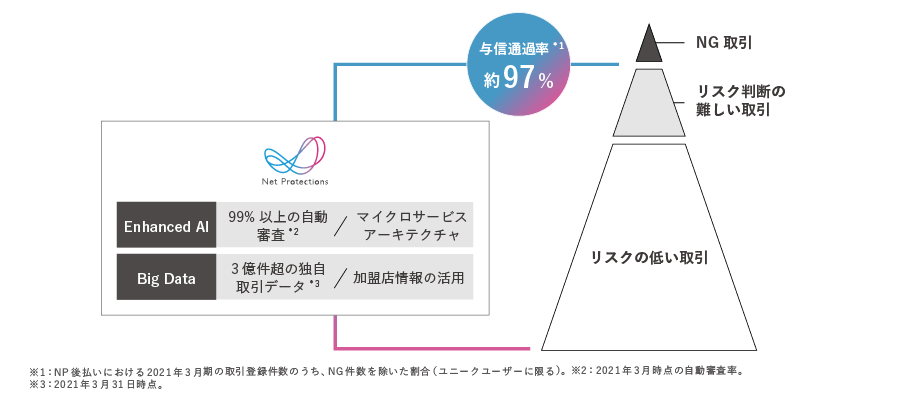

業界最大手である当社は、後払い決済で最も重要な指標である”与信力”に定評があります。後払い決済は、与信審査を厳しくしすぎると事業者様の売上向上メリットが少なくなりますが、緩くしすぎると不正取引を検知できず、未回収率のコントロールが難しくなりサービス品質の維持が難しくほか、商品の転売等によるブランド毀損をマーチャント様に引き起こします。

当社では、20年以上日本のEC業界で後払いを運営し蓄積したデータと与信ノウハウを活用することで、97%以上の与信通過率でありながら、ビジネス上も健全な未回収率の維持に成功しています。この与信力を武器に、高いサービス品質で様々な事業者様の売上向上に寄与してきました。

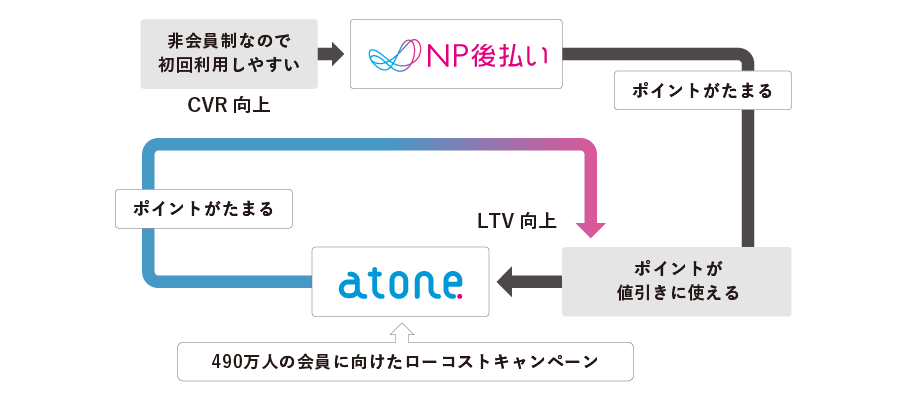

ポイントが貯まる唯一の後払い決済のため、CVR向上だけでなくLTV強化も同時に実現

「NP後払い」は会員登録不要で即時に利用できるため、新規顧客のカゴ落ち防止によるCVR向上に貢献する後払い決済です。「atone」は独自の会員制ポイントプログラムとスマホ最適なUXで、繰り返し利用を促進し既存顧客のリピート率向上とLTV強化に貢献する後払い決済です。

併用導入いただくことで、新規のカゴ落ち防止と既存の繰り返し利用促進の双方に対応が可能です。また、「NP後払い」よりも「atone」は決済手数料が低く、事業者様にもお喜びいただいております。

なお、当社では、現在、Shopify利用店舗向けの期間限定導入キャンペーンを実施中です。キャンペーン概要についても合わせてご確認ください。

「Shopify利用店舗向けの期間限定導入キャンペーン」の概要はこちら

「NP後払い」について

「NP後払い」は、BtoC取引のECを対象にしたBNPL決済サービスです。年間流通金額3,422億円、年間ユニークユーザー数(※2)は1,580万人と「日本で7人に1人が使っている決済(※3)」にまで成長しました。購入者はクレジットカードの情報登録が不要、かつ商品受取り後にお支払いができることから、はじめて利用するECショップでも安心してお買い物を楽しむことができます。また事業者はネットショッピングにおける約20%の後払いニーズ(※4)を、未回収リスクなく提供できることで売上の向上が期待できます。

詳細はこちら:https://www.netprotections.com/

※2)2020年4月1日~2021年3月31日における「NP後払い」の利用者のうち、氏名・電話番号の双方が一致する利用者。

※3)15歳以上の人口1億1,048万人(総務省、人口統計、2021年4月1日時点概算値を参照)と当社実績(1,580万人)をもとに算出。

※4)当社調査より。

「atone」について

「atone」は、明瞭さで選ばれる決済プラットフォームです。ポイントプログラムを通して「あえてクレジットカードを利用しない」490万人(※5)のお客様にアプローチでき、新規獲得・リピート率UP・LTV向上に貢献します。業界最安水準の手数料で、EC・デジタルコンテンツ・実店舗など様々な業種で導入が可能です。ご利用される方のお支払いは、まとめて翌月払いでOK。代金の0.5%のポイントがもらえて値引きに使える上に、簡単な会員登録のみですぐにご利用でき、利用状況はアプリでいつでも確認できます。

詳細はこちら:https://atone.be/

※5)2021年9月現在のNP会員数(退会を除く)

株式会社ネットプロテクションズ概要

当社は国内 BNPL 決済サービスのパイオニアであるとともに、BtoC 取引向け国内 BNPL 決済サービス市場において 40% 以上(※6)のシェアを誇るリーディングカンパニーです。2002年より、日本で初めて未回収リスク保証型の後払い決済サービス「NP後払い」の提供を開始し、2020年度の年間流通金額では前年比約16%の成長率、年間ユニークユーザー数が1,580万人に達し、2021年3月までに累計取引件数が2.8億件を突破するまでに至りました。2011年より、同サービスにより培った独自の与信ノウハウとオペレーション力を企業間取引向けに展開した「NP掛け払い」の本格販売を開始し、2020年度の年間流通金額では前年比約27%の成長率で伸長しています。2017年には、購買体験がこれまでより快適になるやさしい後払い決済「atone(アトネ)」の提供を開始しました。さらに2018年には、台湾においてもスマホ後払い決済サービス「AFTEE(アフティー)」をリリースしました。当社はこれらの事業運営によって高い技術と豊富な実績に基づいた与信とオペレーションが構築されており、決済サービスを通じて誰もが安心かつスムーズに商取引できる社会の実現を目指しています。

【商号】

株式会社ネットプロテクションズ

(株式会社ネットプロテクションズホールディングス[東証プライム、証券コード7383]グループ)

【代表者】

代表取締役社長 柴田 紳

【URL】

https://corp.netprotections.com/

【事業内容】

後払い決済サービス「NP後払い」の運営

企業間決済サービス「NP掛け払い」の運営

訪問サービス向け後払い決済サービス「NP後払いair」の運営

新しいカードレス決済「atone(アトネ)」の運営

台湾 スマホ後払い決済「AFTEE(アフティー)」の運営

ポイントプログラムの運営

【創業】

2000年1月

【資本金】

1億円

【所在地】

〒102-0083 東京都千代田区麹町4丁目2-6 住友不動産麹町ファーストビル5階

※6)矢野経済研究所「2021 年版 オンライン決済サービスプロバイダーの現状と将来予測」より、後払いサービス市場の 2020 年度見込金額(8,820 億円)と「NP 後払い」、「atone」の 2020 年度取扱高合計金額(約 3,600 億円)をもとに算出。

本リリースに関するお問い合わせ

担当 :株式会社ネットプロテクションズ 広報

MAIL : pr@netprotections.co.jp