株式会社ネットプロテクションズ(所在地:東京都千代田区、代表取締役社長:柴田 紳、以下ネットプロテクションズ)は、株式会社エルテックス(所在地:神奈川県横浜市、代表取締役社長:森 久尚 、以下「エルテックス」)が提供するEC/通販の業務をカバーするシステムパッケージの「eltexDC」と、当社が提供する「後払い共通インターフェース(以下「後払い共通IF」)」を10月24日に連携し、本格運用を開始いたしました。

「後払い共通IF」とは

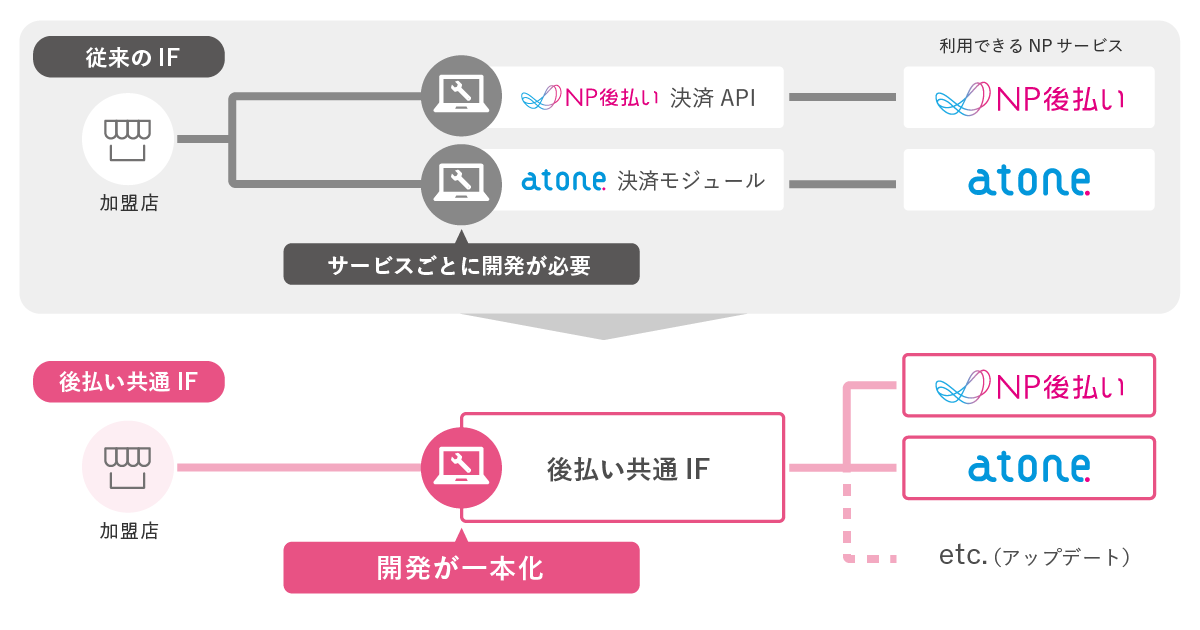

「後払い共通IF」は、当社の「NP後払い」「atone」のシステム接続に関する新仕様です。従来、当社の各種後払い決済サービスは、サービス単位でのシステム開発が必須となっていましたが、「後払い共通IF」により、「NP後払い」「atone」について一度の開発で両サービスとの接続が可能となります。

工数の兼ね合いから、両サービスの同時接続を諦めていた事業者様・パートナー企業様においても、より簡便に両サービスの同時接続に取り組むことができるようになります。

また、システム接続の簡便化だけでなく、各種サービスの提供価値の向上にもつながる仕組みとなっています。

「後払い共通IF」の提供価値

①「NP後払い」のサービス品質が向上

「後払い共通IF」に接続することで、「atone」の一部の仕組みを「NP後払い」においても転用可能となるため、以下のメリットを享受できます。また、今後行われる機能アップデートに継続的に対応が可能になります。

①-1. 与信審査の精度向上、ブランド毀損リスクの削減

現行の与信審査においては、住所/氏名/電話番号の情報のみでは見抜けない不正利用や、プラスαの情報があれば審査OKにできた取引が存在します。「後払い共通IF」に接続することで、「atone」の仕組みを転用した追加情報(IPアドレスや端末情報など)の取得と認証が可能になるため、不正検知力が向上し、転売によるブランド毀損のリスクが低減するほか、審査通過率の改善も可能です。

①-2. 審査保留時の対応工数削減、カゴ落ちの防止

現行の運用においては、住所不備などによる審査保留が発生した場合、お買い物後に加盟店様から購入者様に情報を確認する対応が発生していました。「後払い共通IF」に接続することで、モーダル表示(※1)のご利用が可能となるため、お買い物の途中で購入者様ご自身で審査保留の対応が可能となり、加盟店様の対応工数が削減できるほか、カゴ落ち率も減少します。

※1) 決済画面上にポップアップを表示し、注意文言の表示をしたり、追加情報の入力を誘導したりする仕組み

①-3. 審査NG理由の問い合わせ削減

現行の運用においては、購入者様に審査NGの理由を当社から直接回答することが即時でできず、加盟店へ問い合わせが発生するケースが存在しました。「後払い共通IF」に接続することで、即時与信審査とモーダル表示のご利用が可能となるため、審査NG時に購入者様へ直接理由を開示することや当社への直接の問い合わせ誘導が可能となり、加盟店様の対応工数が削減できます。

②520万人の会員基盤へのアクセスが簡易化

「後払い共通IF」により「atone」の導入が簡便化します。非会員制の「NP後払い」に加えて、会員基盤へのアクセスを得意とする会員制の「atone」に対応することで、以下のメリットを享受できます。

②-1. 初回利用顧客の再購入の促進

「NP後払い」で初回利用した顧客を、ポイントプログラムをもとに「atone」へ誘導し、再購入を促進できます。「atone」で銀行口座を登録すれば支払いが自動化され継続率も向上できます。

②-2. 送客による新規顧客の獲得

「atone」を介して、既存の後払い会員520万人(※2)にポイントやクーポンを用いた販促が可能です。クレジットカードではなく、あえて後払いを選択するユニークな顧客層を新規顧客として取り込む機会を創出します

※2) 2022年3月31日時点におけるNP会員数(退会を除く)

「エルテックス」よりコメント

今回、「eltexDC」と「後払い共通IF」が標準連携したことにより、今後「eltexDC」を導入頂く企業様には「NP後払い」と「atone」の両サービスを簡便にご利用いただく事が可能となります。

さらに、今後行われる「NP後払い」と「atone」の機能アップデートについても継続的に対応可能となる為、多様化する決済方法・サービスに対する対応負荷削減に寄与することを期待しています。

「NP後払い」について

「NP後払い」は、BtoC取引のECを対象にしたBNPL決済サービスです。年間流通金額3,746億円、年間ユニークユーザー数(※3)は1,500万人超と「日本で7人に1人が使っている決済(※4)」にまで成長しました。購入者はクレジットカードの情報登録が不要、かつ商品受取り後にお支払いができることから、はじめて利用するECショップでも安心してお買い物を楽しむことができます。また事業者はネットショッピングにおける約20%の後払いニーズ(※5)を、未回収リスクなく提供できることで売上の向上が期待できます。

詳細はこちら:https://www.netprotections.com/

※3)2021年4月1日~2022年3月31日における「NP後払い」の利用者のうち、氏名・電話番号の双方が一致する利用者。

※4)15歳以上の人口1億1,048万人(総務省、人口統計、2021年4月1日時点概算値を参照)と当社実績(1,530万人)をもとに算出。

※5)当社調査より。

「atone」について

「atone」は、明瞭さで選ばれる決済プラットフォームです。ポイントプログラムを通して「あえてクレジットカードを利用しない」520万人(※2)のお客様にアプローチでき、新規獲得・リピート率UP・LTV向上に貢献します。業界最安水準の手数料で、EC・デジタルコンテンツ・実店舗など様々な業種で導入が可能です。ご利用される方のお支払いは、まとめて翌月払いでOK。代金の0.5%のポイントがもらえて値引きに使える上に、簡単な会員登録のみですぐにご利用でき、利用状況はアプリでいつでも確認できます。

詳細はこちら:https://atone.be/

「eltexDC」について

eltexDC(エルテックス・ディーシー)は、ECフロント機能と、ECおよびコンタクトセンター(電話やオーダーカード受注など)の受注機能を中核に、EC・通販業務に必要な業務・機能をカバーした国内でも数少ないオム二チャネル対応パッケージです。 2014年の販売開始以降、その使い勝手の良さが評価され、国内大手~中堅のEC/通販事業者に数多く採用いただいています。 販売チャネルを問わず、受注、在庫、顧客データなどを一元管理できます。管理効率が飛躍的に向上するだけでなく、「見たい」「使いたい」データをすぐに取り出せますので、攻めの経営や広告・プロモーションにも有効な情報活用で、事業者様の成長に寄与できるソリューションです。

詳細はこちら:https://www.eltex.co.jp/service/commerce/

株式会社ネットプロテクションズ 会社概要

当社は国内BNPL決済サービスのパイオニアです。2002年より、日本で初めて未回収リスク保証型の後払い決済サービス「NP後払い」の提供を開始し、2022年3月までに年間ユニークユーザー数(※6)が1,500万人超に達し、累計取引件数が3.4億件を突破するまでに至りました。2011年より、同サービスにより培った独自の与信ノウハウとオペレーション力を企業間取引向けに展開した「NP掛け払い」の本格販売を開始し、2021年度の年間流通金額では前年比約30%の成長率で伸長しています。2017年には、EC物販だけでなくデジタルコンテンツ・実店舗など様々な業種で導入可能な後払い決済「atone(アトネ)」の提供を開始しました。さらに2018年には、台湾においてもスマホ後払い決済サービス「AFTEE(アフティー)」をリリースしました。当社はこれらの事業運営によって高い技術と豊富な実績に基づいた与信とオペレーションが構築されており、決済サービスを通じて誰もが安心かつスムーズに商取引できる社会の実現を目指しています。

【商号】

株式会社ネットプロテクションズ

(株式会社ネットプロテクションズホールディングス(東証プライム、証券コード7383)グループ)

【代表者】

代表取締役社長 柴田 紳

【URL】

https://corp.netprotections.com/

【事業内容】

後払い決済サービス「NP後払い」の運営

企業間決済サービス「NP掛け払い」の運営

訪問サービス向け後払い決済サービス「NP後払いair」の運営

新しいカードレス決済「atone(アトネ)」の運営

台湾 スマホ後払い決済「AFTEE(アフティー)」の運営

ポイントプログラムの運営

【創業】

2000年1月

【資本金】

1億円

【所在地】

〒102-0083 東京都千代田区麹町4丁目2-6 住友不動産麹町ファーストビル5階

※6)2021年4月1日~2022年3月31日における「NP後払い」の利用者のうち、氏名・電話番号の双方が一致する利用者。

株式会社エルテックス概要

【商号】

株式会社エルテックス

【代表者】

代表取締役社長 森 久尚

【URL】

https://www.eltex.co.jp/

【事業内容】

EC/通販システム構築・支援事業

データセンター事業

メール配信事業

【創業】

1985年12月

【資本金】

1億円

【所在地】

神奈川県横浜市保土ヶ谷区神戸町134番地 横浜ビジネスパークイーストタワー 14階

本リリースに関するお問い合わせ

担当 :株式会社ネットプロテクションズ 広報

MAIL : pr@netprotections.co.jp