To celebrate the listing of NP Atobarai and atone as Shopify’s official applications, Net Protections, Inc. (headquartered in Chiyoda-ku, Tokyo; CEO: Shin Shibata; “Net Protections”) has begun a time-limited offer for Shopify stores. Shopify stores now can prevent customers leaving the store without buying anything in the cart and increase repeat purchases by adopting a BNPL service, which is one of the essential payment methods for E-Commerce in Japan. With this special offer, Net Protections will keep supporting Shopify stores to boost their sales by helping obtain new customers and increase repeat purchases.

<Direct any inquiries regarding the offer to> https://atone.be/contact/cp/shopify-202204/input/(Japanese Only)

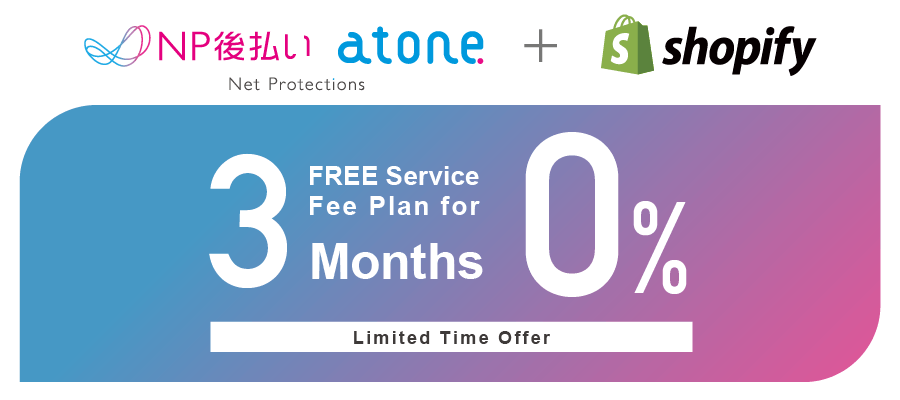

Offer details

Offer Period

April 1, 2022–June 30, 2022

Offer Benefits

For three months from the account issuance month (maximum four months), Shopify stores can use NP Atobarai and atone at the rates below.

Eligible Stores

Any Shopify stores that completed the application during the offer period.

<Direct any inquiries regarding this service to>https://atone.be/contact/cp/shopify-202204/input/(Japanese Only)

※For further information regarding this offer:

https://www.shopify.jp/blog/NP-campaign2022(Japanese Only)

Advantages of adopting BNPL payment service

The adoption of BNPL payment service can help boost sales

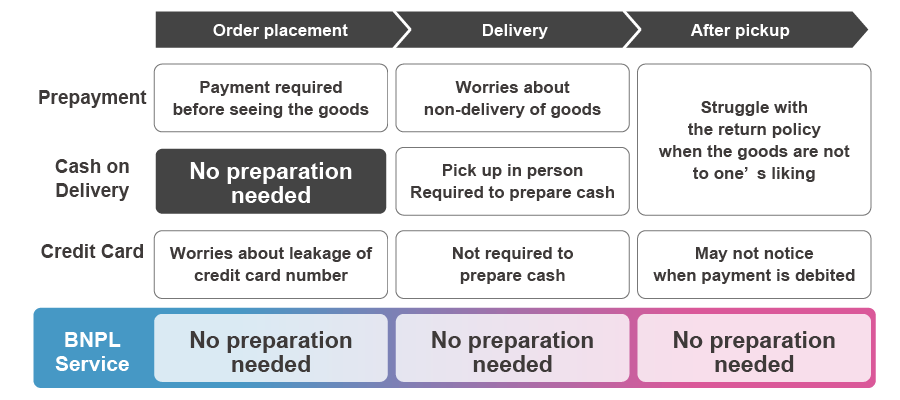

BNPL payment service is the second most popular payment method after credit cards. By offering a high-demand payment method, merchants can prevent customers leaving the store without buying anything in the cart and increase repeat purchases. The method is also highly suited for smartphones and can increase conversions (from both PCs and smartphones) from users who would find it hard to pull out their credit card because they are on the way to school or work, waiting to meet someone, or in bed before going to sleep, thus boosting your sales.

In addition, some consumers make it a rule to use BNPL rather than their credit card when making an initial purchase from their first visited online retailers.

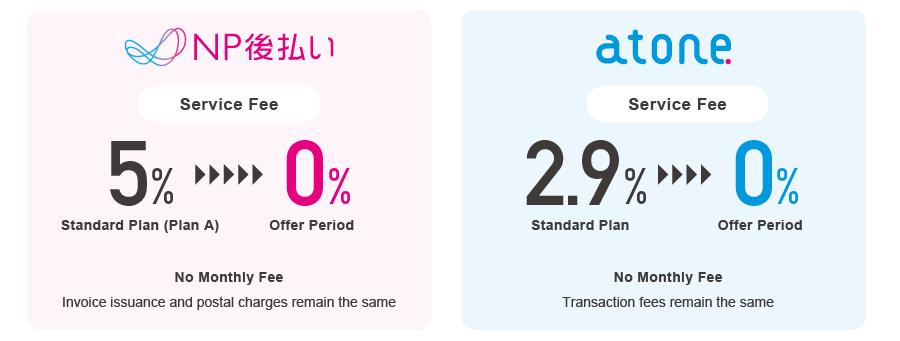

Figure: Features of BNPL compared to other payment methods

Figure: demand of BNPL

<Direct any inquiries regarding this service to>https://atone.be/contact/cp/shopify-202204/input/(Japanese Only)

Net Protections’ strength in BNPL

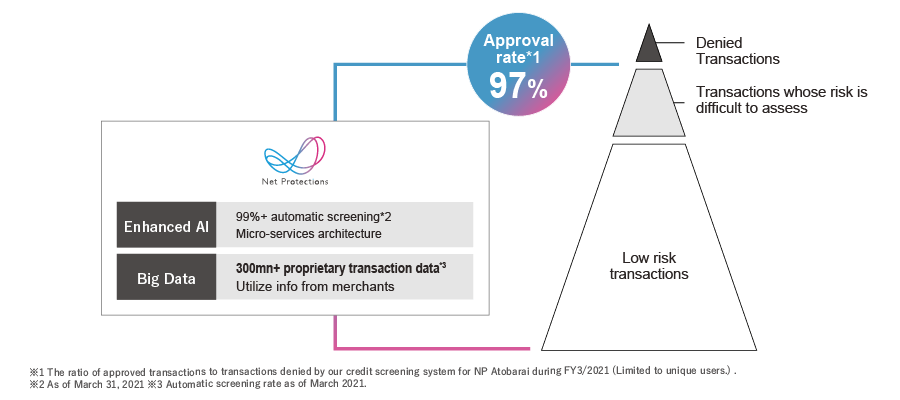

Solid contribution to boosting sales through sophisticated credit screening system

As the leading company in BNPL, Net Protections has a high reputation for its sophisticated credit screening model. If credit screening is too strict, the benefits of sales improvement are small, but it is too loose, it is difficult to detect fraudulent transactions and control the unpaid rate, making it difficult to properly maintain service quality. Not only that, it may cause brand damage to merchants due to product resales.

Net Protections has a track record of over 20 years providing BNPL services in the Japanese e-commerce market, and by utilizing the data and credit know-how we have accumulated, we have succeeded in maintaining delinquency rates at a healthy level for business while achieving the approval rate over 97% of credit purchases.

With this sophisticated credit screening model as a weapon, we have supported various businesses to grow their sales.

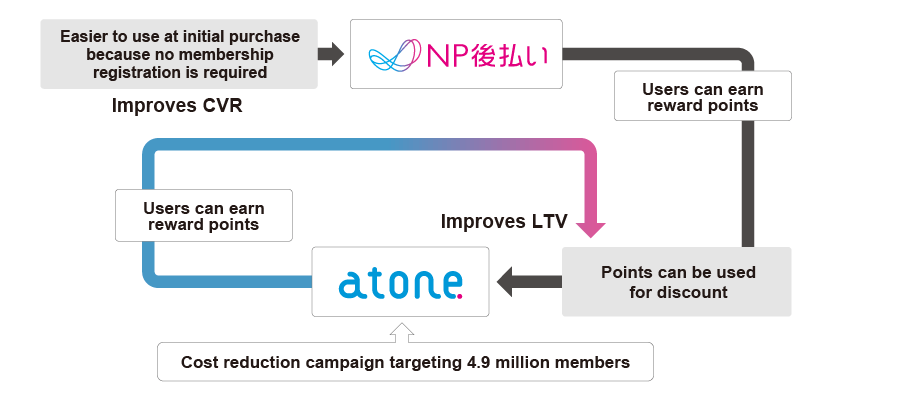

As the only BNPL payment service with a point reward program, merchants can not only increase CVR but also strengthen their LTV

NP Atobarai contributes to increasing CVR because it does not require any sign-up and can be used immediately. atone is another BNPL payment service that offers a unique membership point reward program and provides a UX optimized for smartphones, so it encourages repeat use, helping boost the repeat purchase rate for existing customers and strengthen LTV.

By offering both services, Merchants can both reduce new customers’ cart abandonment rate and promote existing customers to purchase repeatedly.

<Direct any inquiries regarding this service to>https://atone.be/contact/cp/shopify-202204/input/(Japanese Only)

Partner Merchant Case Studies

For further information regarding NP Atobarai’s partners: https://www.netprotections.com/case/(Japanese Only)

For further information regarding atone’s partners: https://atone.be/business/ec/case/(Japanese Only)

About NP Atobarai

NP Atobarai is a Buy Now Pay Later (BNPL) payment service for BtoC E-commerce. It processes transactions exceeding 342.2 billion JPY with over 15.8 million unique users yearly(※1), making it the most experienced and trusted in Japan’s BNPL industry. NP Atobarai offers customers payment after delivery service with a simple payment process, and no credit card information is required.

1 out of 7 Japanese has used NP Atobarai as payment method(※2). Customers find NP Atobarai easy and safe to use, especially with their first-time visited online retailers. Businesses using NP Atobarai have achieved 20% increase in sales(※3) without concerning customers’ unpaid risk.

For further information regarding NP Atobarai: https://www.netprotections.com/(Japanese Only)

※1)The number of individual unique users of NP Atobarai based on the matching of duplicative names and phone numbers during FY3/2021 (April 1, 2020 to March 31, 2021).

※2)Based on “Preliminary counts of population of Japan” by Statistics Bureau of Japan (As of Apr.1, 2021) which estimated the number of individuals aged 15 years and older amounted to 110.48 million people in Japan and the number of NP Atobarai's annual unique users (15.8 million).

※3)Source: Company information.

About atone

atone is a cardless BNPL payment service known for its easiness and clarity. Through the point reward system, merchants can reach 4.9 million non-credit card users (※4), contributing to the improvement of the new acquisition, LTV, and repurchase rate. It can be introduced in various industries such as E-Commerce, digital content, and even physical stores with reasonable service fee. Users can consolidate their purchases into a single invoice in the month and pay in the following month. Also, 0.5% of the purchase is rewarded as NP point and can be used for discounts. Customers can use atone immediately with a simple sign-up and easily check the usage status and purchase history any time on the app.

For further information regarding atone: https://atone.be/shop/(Japanese Only)

※4)Source: Company information. The number of NP members (excluding the withdrawing member) as of Sep. 2021.

Overview of Net Protections, Inc.

Net Protections, Inc. is a pioneer company in Buy Now Pay Later (BNPL) services in Japan and is leading the market with the largest market share (※4). In 2002, Net Protections launched its first service, NP Atobarai, a BNPL that guarantees risk-free transactions for businesses and provides a deferred payment for customers in Japan for the first time. In FY2020, NP Atobarai’s annual transaction volume has hit the growth rate of 116% compared to the previous fiscal year. NP Atobarai is used by numerous enterprises with over 15.8 million unique users in Japan (※5) and has processed more than 280 million transactions to date. In 2011, Net Protections released NP Kakebarai, a BNPL service for BtoB. NP Kakebarai has grown 127% yearly and played a role as the dominant BtoB payment service in Japan. In 2017, Net Protections launched atone, BtoC BNPL service with membership benefits that offers better shopping experience. In 2018, Net Protections released AFTEE, BtoC BNPL service in Taiwan. Net Protections has accumulated transaction data and knowledge since its first service launched, which has enabled it to build a sophisticated credit screening system and solid operation skills. Net Protections always pursues creating a society where everyone can do business safely and easily.

【Company Name】

Net Protections, Inc.

(Net Protections Holdings, Inc.[Code: 7383, Prime Market of Tokyo Stock Exchange] Group)

【CEO】

Shin Shibata

【Website】

https://corp.netprotections.com/

【Business Outline】

BtoC e-commerce BNPL (Buy Now Pay Later) Service, NP Atobarai

BtoB BNPL Service, NP Kakebarai

BtoC BNPL Service, NP Atobarai air for individual day-to-day operations

BtoC BNPL Service with membership benefits, atone

BtoC BNPL Service in Taiwan, AFTEE

Point Reward System, NP Point Club

【Founded】

January, 2000

【Capital】

JPY 100 million

【Headquarter】

SUMITOMO FUDOSAN KOJIMACHI FIRST BUILDING 5F, 4-2-6 Kojimachi, Chiyoda-ku, Tokyo 102-0083 Japan

※5)Calculated based on the estimated size of BNPL market in Japan of JPY882 billion in FY2020 and the aggregate of GMV of NP Atobarai and atone in FY2020 of JPY360 billion. The estimated size of BNPL market in Japan is provided from Yano Research Institute “Online Payment/Settlement Service Providers 2021”

※6)The number of individual unique users of NP Atobarai based on the matching of duplicative names and phone numbers during FY3/2021 (April 1, 2020 to March 31, 2021).

Direct any inquiries regarding this release to:

企業・個人の方はこちら

担当 :株式会社ネットプロテクションズ 広報

MAIL : pr@netprotections.co.jp