株式会社ネットプロテクションズ(所在地:東京都千代田区、代表取締役社長:柴田 紳、以下当社)は、株式会社wevnal(所在地:東京都渋谷区、代表取締役社長:磯山 博文 、以下「wevnal」)が提供するBXプラットフォーム「BOTCHAN(ボッチャン)」と、当社が提供する「NP後払い」を連携し、本格運用を開始いたしました。

即時与信機能に連携対応した背景は、共通加盟店のコンバージョン率の向上

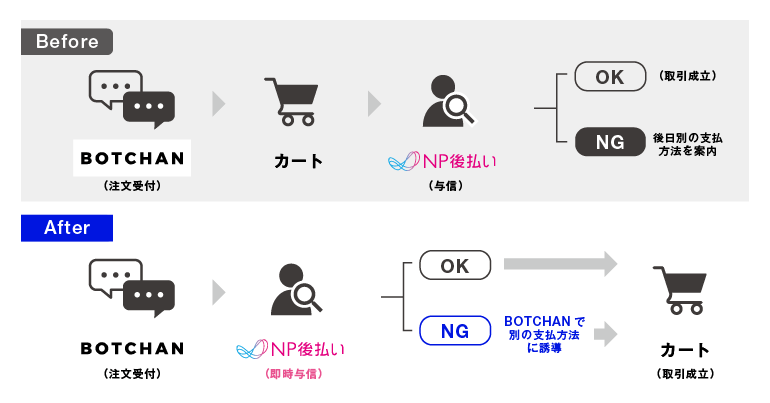

「BOTCHAN」と「NP後払い」をともに導入された加盟店は以下2点によって、コンバージョン率の向上が期待できます。

1,今後は「BOTCHAN」上で「NP後払い」の与信が完了し、与信NG(与信不通過)による購入の離脱防止が期待できます。従来は「BOTCHAN」からまずカートに遷移して注文が完了し、その後に「NP後払い」の与信を実施していたため、与信NGになった場合に購入者の離脱が起きていました。今後は、与信NGになった取引を「BOTCHAN」上で別決済に誘導してカートに遷移、注文確定することができるようになります。

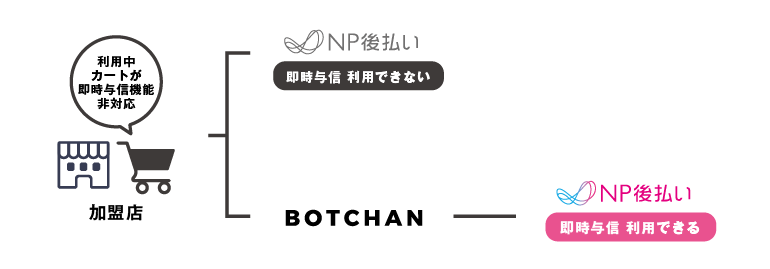

2,「NP後払い」の即時与信機能が未実装のカートを利用していても、「BOTCHAN」を利用することで「NP後払い」の即時与信機能の利用が可能になります。即時出荷の運用を組まれている加盟店様は「NP後払い」が利用しやすくなり、また購入者は決済時に与信のOK/NGがわかるため、満足度の向上にも期待できます。

「NP後払い」について

「NP後払い」は、BtoC取引のECを対象にしたBNPL決済サービスです。年間流通金額3,746億円、年間ユニークユーザー数(※1)は1,500万人超と「日本で7人に1人が使っている決済(※2)」にまで成長しました。購入者はクレジットカードの情報登録が不要、かつ商品受取り後にお支払いができることから、はじめて利用するECショップでも安心してお買い物を楽しむことができます。また事業者はネットショッピングにおける約20%の後払いニーズ(※3)を、未回収リスクなく提供できることで売上の向上が期待できます。

詳細はこちら:https://www.netprotections.com/

※1)2021年4月1日~2022年3月31日における「NP後払い」の利用者のうち、氏名・電話番号の双方が一致する利用者。

※2)15歳以上の人口1億1,048万人(総務省、人口統計、2021年4月1日時点概算値を参照)と当社実績(1,530万人)をもとに算出。

※3)当社調査より。

「BOTCHAN」について

BOTCHAN(ボッチャン)は、消費者および企業のLTV最大化をブランド体験(Brand Experience)の向上を通じて実現する BXプラットフォームです。D2C業界を中心に累計600社以上の企業に導入されています。消費者とのタッチポイントとなるそれぞれのファネルで一貫したブランドサクセス支援を行うことで、快適なBXを提供し、企業のブランド体験の価値向上に寄与します。

「BOTCHAN」の詳細はこちら:https://botchan.chat/

株式会社ネットプロテクションズ 会社概要

当社は国内 BNPL 決済サービスのパイオニアです。2002年より、日本で初めて未回収リスク保証型の後払い決済サービス「NP後払い」の提供を開始し、2020年度の年間流通金額では前年比約16%の成長率、年間ユニークユーザー数(※4)が1,500万人超に達し、2022年3月までに累計取引件数が3.4億件を突破するまでに至りました。2011年より、同サービスにより培った独自の与信ノウハウとオペレーション力を企業間取引向けに展開した「NP掛け払い」の本格販売を開始し、2020年度の年間流通金額では前年比約27%の成長率で伸長しています。2017年には、購買体験がこれまでより快適になるやさしい後払い決済「atone(アトネ)」の提供を開始しました。さらに2018年には、台湾においてもスマホ後払い決済サービス「AFTEE(アフティー)」をリリースしました。当社はこれらの事業運営によって高い技術と豊富な実績に基づいた与信とオペレーションが構築されており、決済サービスを通じて誰もが安心かつスムーズに商取引できる社会の実現を目指しています。

【商号】

株式会社ネットプロテクションズ

(株式会社ネットプロテクションズホールディングス(東証プライム、証券コード7383)グループ)

【代表者】

代表取締役社長 柴田 紳

【URL】

https://corp.netprotections.com/

【事業内容】

後払い決済サービス「NP後払い」の運営

企業間決済サービス「NP掛け払い」の運営

訪問サービス向け後払い決済サービス「NP後払いair」の運営

新しいカードレス決済「atone(アトネ)」の運営

台湾 スマホ後払い決済「AFTEE(アフティー)」の運営

ポイントプログラムの運営

【創業】

2000年1月

【資本金】

1億円

【所在地】

〒102-0083 東京都千代田区麹町4丁目2-6 住友不動産麹町ファーストビル5階

※4)2021年4月1日~2022年3月31日における「NP後払い」の利用者のうち、氏名・電話番号の双方が一致する利用者。

株式会社wevnal 会社概要

【商号】

株式会社wevnal

【代表者】

代表取締役社長 磯山 博文

【URL】

https://wevnal.co.jp

【事業内容】

BX(Brand Experience)プラットフォーム「BOTCHAN」の開発と提供

【設立】

2011年4月

【資本金】

319,952,000円(2021年8月末現在、資本剰余金を含まない)

【所在地】

〒150-0013 東京都渋谷区恵比寿1-23-23 恵比寿スクエア 7階【商号】

本リリースに関するお問い合わせ

担当 :株式会社ネットプロテクションズ 広報

MAIL : pr@netprotections.co.jp

お問い合わせ