Net Protections, Inc. (headquartered in Chiyoda-ku, Tokyo; CEO: Shin Shibata; “Net Protections'') has been offering atone, Buy Now Pay Later (BNPL) service, with a membership-based ‘Next month payment’ scheme. However from May 2023, a new scheme called ‘BNPL per purchase,’ has been launched. In stores where these two schemes were introduced, the ratio of customers choosing atone for their payment method increased to 23% on average, and the GMV doubled as a result.

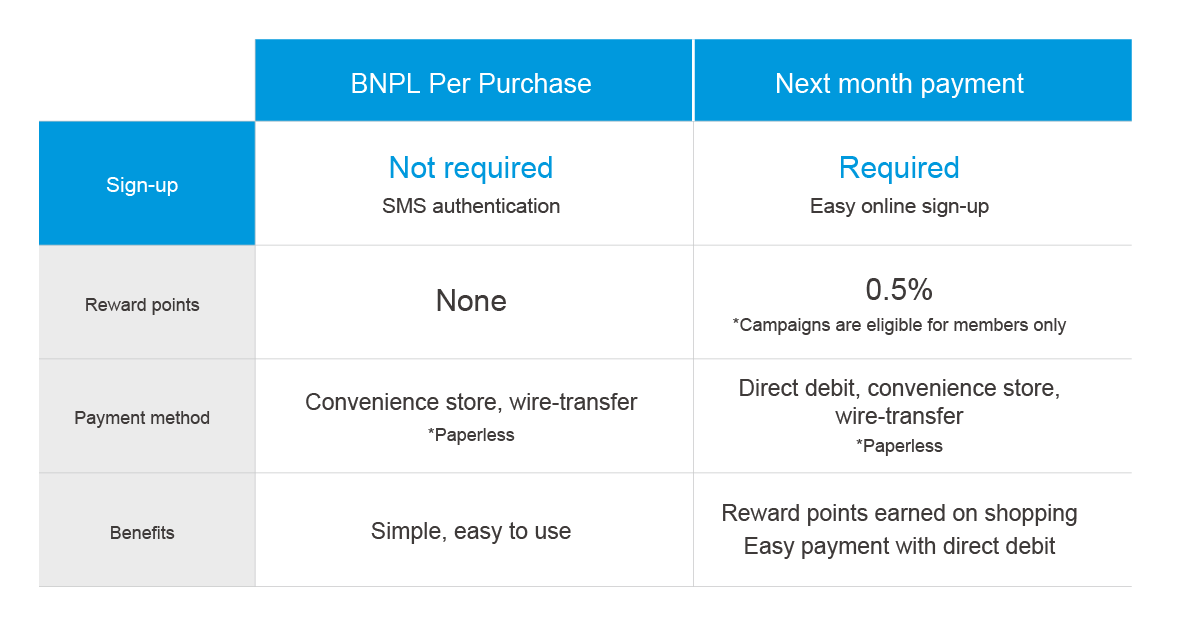

Overview of BNPL per purchase and Next month payment

BNPL per purchase does not require membership registration and allows users to pay each transaction on a later date. On the other hand, Next month payment requires membership, but allows members to consolidate all the bills and pay in the following month.

<Comparison between BNPL per purchase and Next month payment>

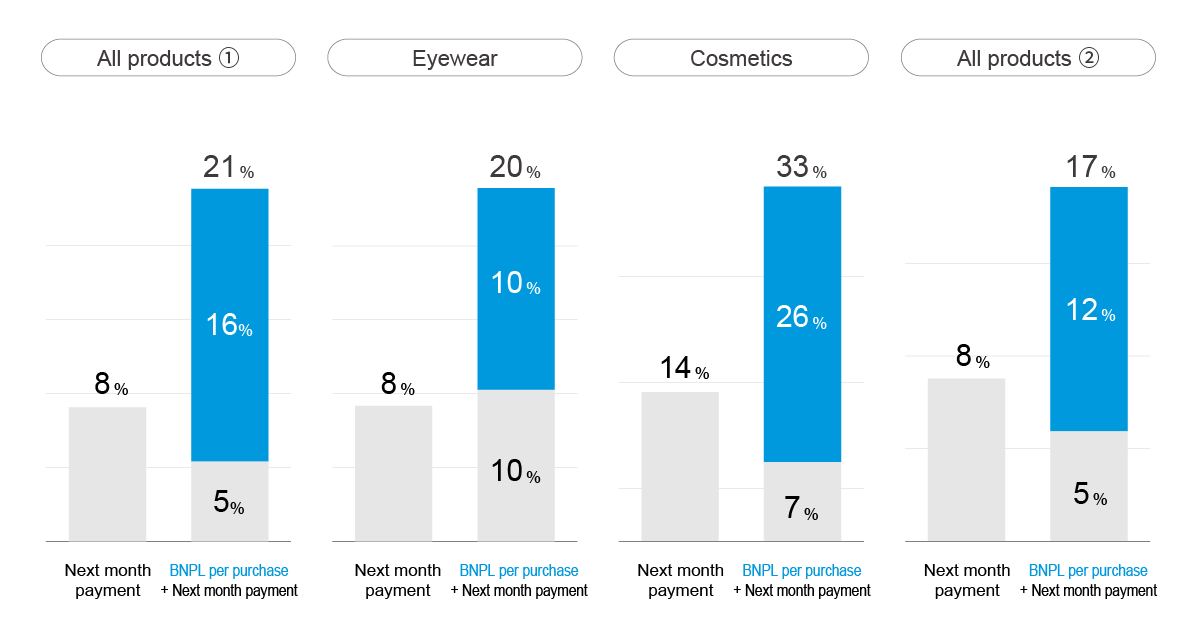

Growth in payment selection rate and GMV

Stores which began using BNPL per purchase showed a significant increase to 23% on average in the payment selection rate. This growth has occurred for all product categories, with some cases exceeding 30%. Thus, the payment selection rate exceeded that of other BNPL services and of QR code payments, making it the second most used payment method after credit cards.

<Changes in payment selection rate>

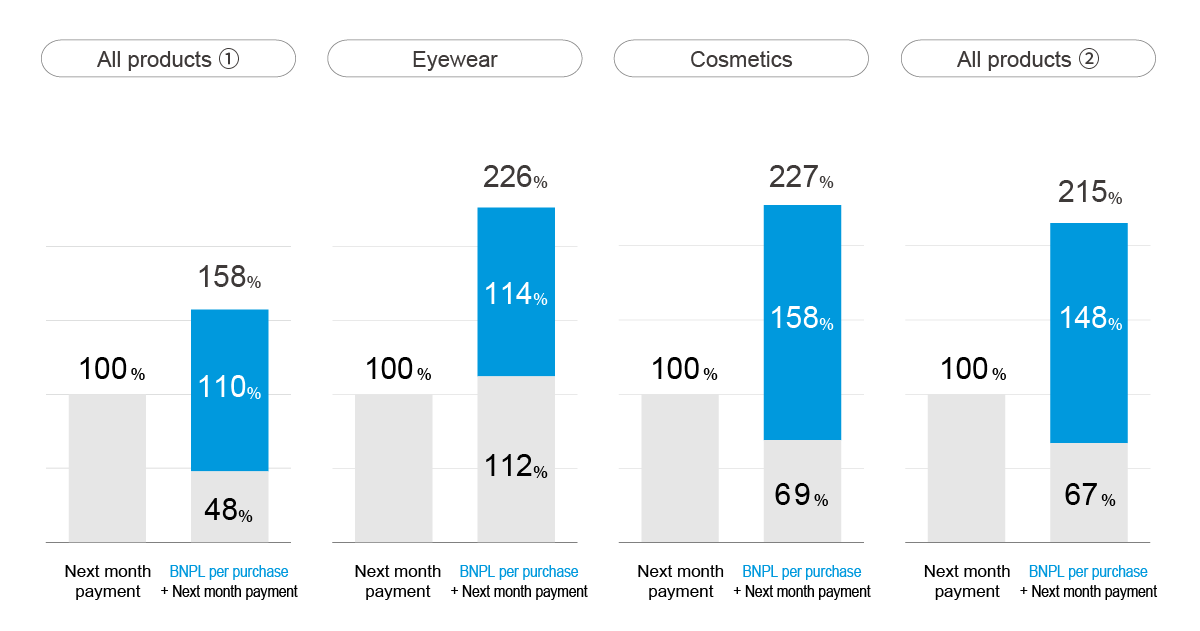

As payment selection rates increased, GMV has doubled for all categories.

<Changes in the GMV>

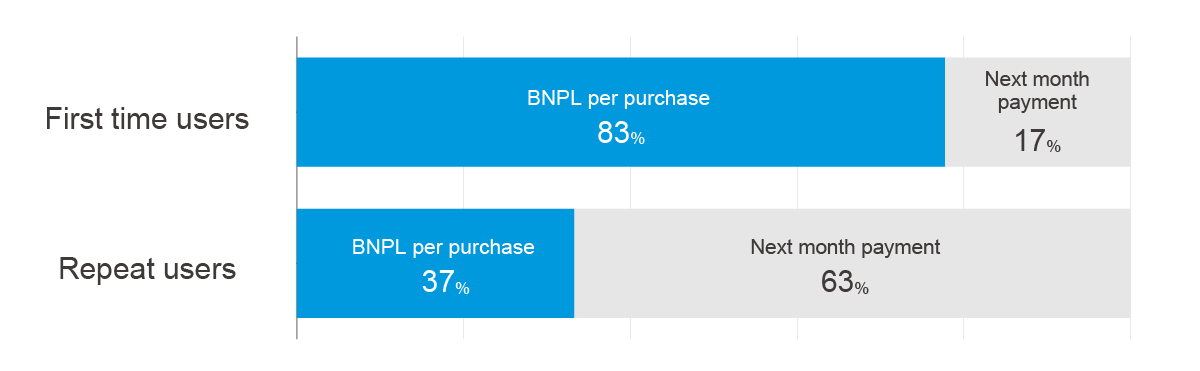

Reasons for the growth in payment selection rate and circulation value

BNPL per purchase has improved convenience for first time BNPL users, as it only requires SMS authentication to use it. As a result, cart abandonment rates decreased, and the number of users choosing BNPL as their payment method increased. In fact, 83% of first-time users used BNPL per purchase. On the other hand, the number of repeat users also increased due to its point rewards and its convenience. The payment selection rate and GMV have grown because the needs of both first-time and repeat users are being met.

<Breakdown for first-time users and repeat users>

Future Developments

From now on, both membership and non-membership services will be promoted to new merchants. In addition, Net Protections will promote its non-membership service to merchants that are already using the membership-based service. Through strengthening integration with shopping cart system providers Net protections aims to increase the number of stores that provide BNPL per purchase by 10 times by the fiscal year ending March 31, 2024.

About atone

atone is a smartphone-based BNPL service that can be used for both online and physical stores. Buyers can buy now and pay later immediately without registering a bank account, credit card information, or adding funds. On the other hand, atone merchants can prevent cart abandonment which customers leave the site without completing their purchase. In physical stores, atone can contribute to cashless without losing buyers who own credit cards but do not use them. The reward points program makes new acquisition and repeat purchases easier.

For more information about atone:https://atone.be/

About Net Protections, Inc.

商号 :株式会社ネットプロテクションズ

(株式会社ネットプロテクションズホールディングス(東証プライム、証券コード7383)グループ)

代表者 :代表取締役社長 柴田 紳

URL :https://corp.netprotections.com/

事業内容 :後払い決済サービス各種

創業 :2000年1月

資本金 :1億円

所在地 :東京都千代田区麹町4丁目2-6 住友不動産麹町ファーストビル5階

Direct any inquiries regarding this release to:

Net Protections PR

Email: pr@netprotections.co.jp