JCB Co., Ltd. (headquartered in Minato-ku, Tokyo; President and CEO: Ichiro Hamakawa; “JCB”) and Net Protections, Inc. (headquartered in Chiyoda-ku, Tokyo; CEO: Shin Shibata; “Net Protections”) have signed a comprehensive white label agreement for Net Protections’ Buy Now Pay Later (BNPL) services (NP Atobarai, atone, NP Atobarai air, and NP Kakebarai). JCB will begin promoting BNPL services under this agreement in 2023.

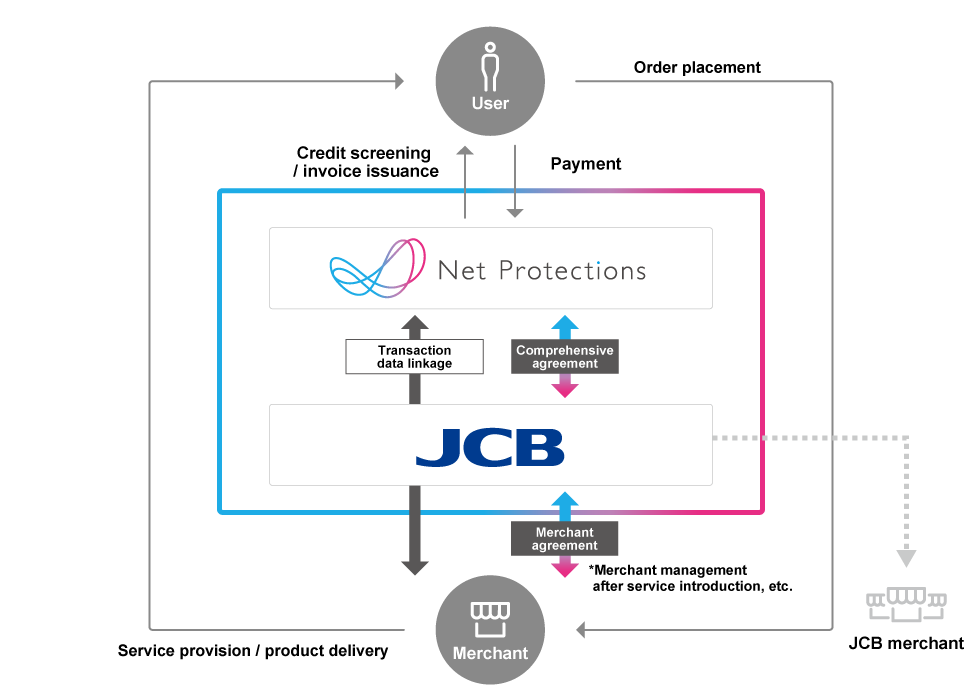

Overview of the comprehensive white label agreement

This comprehensive white label agreement covers BNPL services, with JCB handling merchant acquisition, management, and account settlement and Net Protections handling credit screening and transaction management. Specifically, the four BNPL services of Net Protections (NP Atobarai, atone, NP Atobarai air, and NP Kakebarai) will be handled as JCB services with JCB signing agreements with its merchants directly and managing the accounts once the services begin. This will allow JCB to offer BNPL services to its merchants on top of the existing credit card, electronic money, and QR code payment services already offered.

Background and purpose of the comprehensive white label agreement

JCB and Net Protections began promoting their cooperation in earnest upon entering a capital alliance in February 2021. As the first stage of specific efforts, JCB began referring Net Protections’ BNPL services to its merchants in August 2021 (※1). As the second stage, some of JCB’s franchisees (※2), which include financial institutions nationwide, began referring Net Protections’ BNPL services in June 2022. Franchisees will continue to refer these services, and as the third stage, JCB has signed a comprehensive white label agreement in the aim of further improving the operational efficiency of merchants, increasing their sales, and improving convenience for users by promoting BNPL services nationwide in addition to its existing payment services.

*1. See the press release for the service referral partnership between JCB and Net Protections here (Japanese only).

*2. Franchisees are financial institutions and their affiliates that have signed franchise agreements with JCB for the issuance of JCB credit cards and merchant services. See the press release for the launch of Net Protections service referrals to JCB franchisees nationwide here.

About the services

NP Atobarai

NP Atobarai is a Buy Now Pay Later (BNPL) service for BtoC e-commerce. As the first BNPL service in Japan, it has become the most used and trusted BNPL service in Japan. It yearly processes transactions over JPY 374.5 billion with more than 15 million unique users (※3). NP Atobarai provides a simple & easy-to-use BNPL service, and no credit card information is required.

One out of every 7 people in Japan reported that they have paid with NP Atobarai (※4). Customers find NP Atobarai easy and safe to use, especially with their first-time visiting online retailers because they can pay with confidence after the arrival of the order. Also, for NP Atobarai stores, merchants can satisfy demand for BNPL that takes up 20% of online shopping (※5) and expect sales increase while preventing risks.

▶ For further information regarding NP Atobarai:https://www.netprotections.com (Japanese only)

※3)The number of individual unique users of NP Atobarai based on the matching of duplicative names and phone numbers during FY2021 (April 1, 2021 to March 31, 2022)

※4)Based on “Preliminary Counts of Population of Japan” by Statistics Bureau of Japan (As of April 1, 2021) which estimated the number of individuals aged 15 years and older amounted to 110.5 million people in Japan and the number of NP Atobarai's annual unique users (15.3 million)

※5)Based on our research

NP Kakebarai

NP Kakebarai is a BtoB Buy Now Pay Later (BNPL) service that guarantees risk-free transactions and enables to reduce the complicated billing/payment process between merchants and their clients through credit screening, billing, collection, payment confirmation, and payment reminder. With NP Kakebarai, businesses can outsource and digitally transform the whole billing process, thus it is able to reduce unnecessary operations and boost productivity. In addition, NP Kakebarai's sophisticated credit screening system which does not rely on the traditional Credit Bureau, accurately detects delinquency risk while maintaining 99% approval rate (※6), thus merchants can easily handle SMEs, even individual businesses while preventing risks. Therefore, it contributes to merchants’ sales increase and market expansion, also improvement of cash flow for clients for its flexible payment deadline. As of 2022, NP Kakebarai's annual transaction volume is JPY 97.9 billion, and 460,000 companies, or one out of every eight companies in Japan, use the service annually (※7). NP Kakebarai will continue to be dedicated to providing the service creating a sustainable environment in which all stakeholders can challenge and grow more freely.

▶ For further information regarding NP Kakebarai: https://np-kakebarai.com (Japanese only)

※6)As of March 31, 2022

※7)Based on “Report of the 2019 Basic Survey on Small and Medium-sized Enterprises” which estimated the number of Japan enterprise to 3.85 million and the number of companies using NP Kakebarai

NP Atobarai air

NP Atobarai air is a BtoC Buy Now Pay Later (BNPL) service for on-site services. It can be used in various fields such as home appliance repair, maintenance, home/office cleaning, and rental services. With its simple & easy process, NP Atobarai air allows businesses to manage the complicated procedures such as billing, collection, payment confirmation, and non-payment risk. Also, as a customer friendly service, it offers various payment options; wire-transfer, convenience store payment, post office payment, and LINE Pay.

▶ For further information regarding NP Atobarai air: https://www.netprotections.com/air (Japanese only)

atone

atone is a cardless Buy Now Pay Later (BNPL) service well-known for its simplicity and clarity. With its point reward program, atone stores can approach 5.29 million non-credit card users (※8) and expect the increase of new customer acquisition, LTV, and repeat purchase rate. atone can be used in various fields such as e-commerce, digital content, and even physical stores. Customers can consolidate their orders into a single invoice in the month and pay in the following month. Also, 0.5% of the purchase is rewarded as NP points and can be used for discounts anytime. For the first-time users, it is possible to pay with atone immediately with a simple sign-up, and users can easily check the usage status and purchase history on the app.

▶ For further information regarding atone:https://atone.be/shop (Japanese only)

※8) Based on the number of the registered NP members as of March 31, 2022

■About JCB Co., Ltd.

As Japan’s only international credit card brand, JCB is building a network of merchants that accept JCB credit cards and expanding the issuance of JCB credit cards through partnerships in Japan and abroad, primarily in Asia. It is also developing various businesses to meet the expectations of its customers and partners in the aim of solidifying itself as a comprehensive payment solution provider. There are currently more than 140 million JCB cardmembers around the world (as of March 2022).

https://www.global.jcb/en/

■About Net Protections, Inc.

Net Protections, Inc. is a pioneer of Buy Now Pay Later (BNPL) services in Japan. In 2002, Net Protections launched its first service, NP Atobarai, a BNPL that guarantees risk-free transactions for businesses and provides a deferred payment for customers in Japan for the first time. NP Atobarai is used by numerous enterprises with over 15 million users (※9) and has surpassed 340 million transactions as of March, 2022. In 2011, Net Protections released NP Kakebarai, a BNPL service for BtoB. NP Kakebarai has grown 130% yearly and played a role as the dominant BtoB payment service in Japan. In 2017, Net Protections launched atone, BtoC BNPL service that can be used at not only e-commerce, but also digital content and physical retailers. In 2018, Net Protections released AFTEE, BtoC BNPL service in Taiwan. Net Protections has accumulated transaction data and knowledge since its first service launched, which has enabled it to build a sophisticated credit screening system and solid operation skills. Net Protections always pursues creating a society where everyone can do business safely and easily.

【Company Name】

Net Protections, Inc.

(Net Protections Holdings, Inc.[Code: 7383, Prime Market of Tokyo Stock Exchange] Group)

【Representative】

Shin Shibata, CEO

【Website】

https://corp.netprotections.com/en/

【Services】

BtoC e-commerce Buy Now Pay Later (BNPL) service, NP Atobarai

BtoB BNPL Service, NP Kakebarai

BtoC BNPL service for on-site services, NP Atobarai air

BtoC cardless BNPL service, atone

BtoC BNPL Service in Taiwan, AFTEE

Point reward program, NP Point Club

【Founded】

January, 2000

【Capital】

JPY 100 million

【Head Office】

SUMITOMO FUDOSAN KOJIMACHI FIRST BUILDING 5F, 4-2-6 Kojimachi, Chiyoda-ku, Tokyo 102-0083 Japan

※9)The number of individual unique users of NP Atobarai based on the matching of duplicative names and phone numbers between April 1, 2021 to March 31, 2022

Direct any inquiries from media regarding this release to:

JCB

Representative:Takada, Nakajima (PR)

Tel: +81-3-5778-8353

Email: jcb-pr@jcb.co.jp

Net Protections

PR

Email: ir_pr@netprotections.co.jp

Direct any inquiries from businesses and individuals regarding this release to:

FP&A Group of Net Protections Holdings

Tel: +81-3-4530-9235

Email: ir@netprotections.co.jp