株式会社ネットプロテクションズ(所在地:東京都千代田区、代表取締役社長:柴田 紳、以下ネットプロテクションズ)は、ベリテワークス株式会社(所在地:東京都北区、代表取締役:浅賀 桃子、以下ベリテワークス)が日本で展開を推進しているEコマースプラットフォーム「Magento Open Source(マジェント オープンソース)」(以下、Magento)並びに、アドビ(Nasdaq:ADBE)(本社:カリフォルニア州サンノゼ、以下アドビ)が提供する「Adobe Commerce(アドビコマース)」(※1)と、当社が提供する「後払い共通インターフェース(以下「後払い共通IF」)」を連携し、本格運用を開始いたしました。

※1)Adobe CommerceはAdobe Experience Cloudのソリューションの1つです。

「後払い共通IF」とは

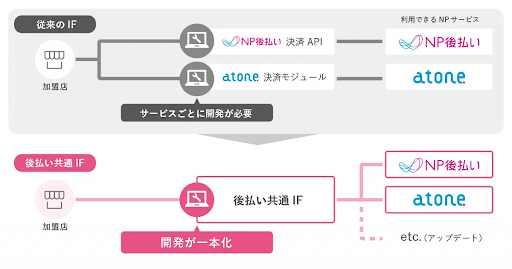

「後払い共通IF」は、当社の「NP後払い」「atone」のシステム接続に関する新仕様です。

従来、当社の各種後払い決済サービスは、サービス単位でのシステム開発が必須となっていましたが、「後払い共通IF」により、「NP後払い」「atone」について一度の開発で両サービスとの接続が可能となります。

工数の兼ね合いから、両サービスの同時接続を諦めていた事業者様・パートナー企業様においても、より簡便に両サービスの同時接続に取り組むことができるようになります。

また、システム接続の簡便化だけでなく、各種サービスの提供価値の向上にもつながる仕組みとなっています。

従来より越境EC、グローバル展開、複数ブランドの収容、B2C,B2Bのハイブリットサイトなど、幅広い顧客層と用途で利用されているMagento、Adobe Commerce向けには、ベリテワークスより「NP後払い」「atone」を別々のExtensionで提供されていました。今回の「後払い共通IF」を採用した1つのExtensionで「NP後払い」「atone」の両方に接続が可能になりました。

Magentoでのご利用方法について

Magentoでの共通IF連携にはベリテワークスが提供するエクステンションを利用しています。

以下のURLよりエクステンションを購入可能です。

・https://principle-works.jp/m2-np-postpay-atone

※利用開始には別途ネットプロテクションズへの申込みが必要です。

・NP後払い:https://www.netprotections.com/inquiry/application/input/

・atone:https://atone.be/contact/ec/application/input/

「後払い共通IF」の提供価値

①「NP後払い」のサービス品質が向上

「後払い共通IF」に接続することで、「atone」の一部の仕組みを「NP後払い」においても転用可能となるため、以下のメリットを享受できます。また、今後行われる機能アップデートに継続的に対応が可能になります。

①-1. 与信審査の精度向上、ブランド毀損リスクの削減

現行の与信審査においては、住所/氏名/電話番号の情報のみでは見抜けない不正利用や、プラスαの情報があれば審査OKにできた取引が存在します。「後払い共通IF」に接続することで、「atone」の仕組みを転用した追加情報(IPアドレスや端末情報など)の取得と認証が可能になるため、不正検知力が向上し、転売によるブランド毀損のリスクが低減するほか、審査通過率の改善も可能です。

①-2. 審査保留時の対応工数削減、カゴ落ちの防止

現行の運用においては、住所不備などによる審査保留が発生した場合、お買い物後に加盟店様から購入者様に情報を確認する対応が発生していました。「後払い共通IF」に接続することで、モーダル表示(※1)のご利用が可能となるため、お買い物の途中で購入者様ご自身で審査保留の対応が可能となり、加盟店様の対応工数が削減できるほか、カゴ落ち率も減少します。

※1) 決済画面上にポップアップを表示し、注意文言の表示をしたり、追加情報の入力を誘導したりする仕組み

①-3. 審査NG理由の問い合わせ削減

現行の運用においては、購入者様に審査NGの理由を当社から直接回答することが即時でできず、加盟店へ問い合わせが発生するケースが存在しました。「後払い共通IF」に接続することで、即時与信審査とモーダル表示のご利用が可能となるため、審査NG時に購入者様へ直接理由を開示することや当社への直接の問い合わせ誘導が可能となり、加盟店様の対応工数が削減できます。

②600万人の会員基盤へのアクセスが簡易化

「後払い共通IF」により「atone」の導入が簡便化します。会員基盤へのアクセスを得意とする会員制の「atone」に対応することで、以下のメリットを享受できます。

②-1. 初回利用顧客の再購入の促進

「NP後払い」で初回利用した顧客を、ポイントプログラムをもとに「atone」へ誘導し、再購入を促進できます。「atone」で銀行口座を登録すれば支払いが自動化され継続率も向上できます。

②-2. 送客による新規顧客の獲得

「atone」を介して、既存の後払い会員600万人(※2)にポイントやクーポンを用いた販促が可能です。クレジットカードではなく、あえて後払いを選択するユニークな顧客層を新規顧客として取り込む機会を創出します

※2) 2023年3月31日時点におけるNP会員数(退会を除く)

「atone」の特徴

①何度利用しても、お支払いは翌月に1回のまとめ払い

「atone」は月内に複数回購入した場合も翌月1回のまとめ払いが可能であるため、支払いの手間が少ないです。

②国内の後払い決済では唯一のポイントプログラム

購入金額に応じて次回の買い物で値引きに使えるポイントがつき、お得にお買い物をお楽しみいただけます。

③多彩な支払い方法

コンビニ払いをはじめ、銀行ATM、口座振替、LINE Payなど多彩な支払い方法からご都合に合わせてお選びいただけます。

「NP後払い」について

「NP後払い」は、BtoC取引のECを対象にしたBNPL決済サービスです。年間流通金額3,746億円、年間ユニークユーザー数(※3)は1,500万人超と「日本で7人に1人が使っている決済(※4)」にまで成長しました。購入者はクレジットカードの情報登録が不要、かつ商品受取り後にお支払いができることから、はじめて利用するECショップでも安心してお買い物を楽しむことができます。また事業者はネットショッピングにおける約20%の後払いニーズ(※5)を、未回収リスクなく提供できることで売上の向上が期待できます。

詳細はこちら:https://www.netprotections.com/

※3)2021年4月1日~2022年3月31日における「NP後払い」の利用者のうち、氏名・電話番号の双方が一致する利用者。

※4)15歳以上の人口1億1,048万人(総務省、人口統計、2021年4月1日時点概算値を参照)と当社実績(1,530万人)をもとに算出。

※5)当社調査より。

「atone」について

「atone」は、通販・実店舗ともに使えるスマホ活用型後払い決済サービスです。購入者はお買い物をした後で代金を支払うことができ、銀行口座やクレジットカード情報の登録やチャージも不要で、すぐに利用可能となります。一方、atoneを導入した通販事業者は、取引成立直前に購入者が離脱してしまう「カゴ落ち」を防止でき、売り上げロスの減少につながります。実店舗では、クレジットカードを保有しているが使わない購入者を取りこぼすことなく、店舗のキャッシュレス化を推進できます。ポイントプログラムも導入しているため、新規獲得・リピート率UP・購買単価の向上にも貢献します。

詳細はこちら:https://atone.be/

「Magento」について

2008年にリリースされた「Magento」は世界3大Eコマースプラットフォームのひとつ。多言語・多通貨対応は当たり前、豊富な機能、堅牢かつ柔軟性のあるアーキテクチャ、高いパフォーマンスにより様々な規制や市場ニーズ、言語がひしめくヨーロッパで高く評価され、多くのユーザーを獲得しています。厳格な品質管理基準に準拠したサードパーティ製の拡張機能やテーマが多数あり、これらを上手に組み合わせることでより短期間に高品質なサイト構築が可能です。オープンソースの無償版「Magento Open Source」、より高機能で大規模サイト向けの有償版「Magento Commerce」、クラウドホスティングが付属する「Magento Commerce Cloud」の3つのエディションがありましたが、2018年5月アドビにより有償版は買収され、2021年4月にAdobe Commerceにブランド統合されました。現在はオープンソースの無償版「Magento Open Source」とアドビブランドの有償版「Adobe Commerce」の構成になっております。サイトの規模や機能要件に合わせて選択することができます。

エディション比較はこちら:https://principle-works.jp/about-magento/editions

ベリテワークス株式会社 概要

ベリテワークスは情報システム開発事業およびカウンセリング・人事労務コンサルティング事業を展開、組織とそこに働く人たちの関係がより円満になるよう「ヒト(カウンセリング)」と「モノ(情報システム)」の両面からサービスを提供しています。情報システム開発事業の柱として、現在世界25万サイト以上で利用されている米国生まれのECプラットフォーム「Magento」に特化。Magentoが正式リリース前より着目、唯一の日本語コミュニティを運用しています。また、国内マーケット向けローカライズ化を進めながら、各種拡張機能開発、ECサイト構築、保守サポートなどを行っています。

【商号】

ベリテワークス株式会社(英語表記:Veriteworks Inc.)

【代表者】

代表取締役 浅賀 桃子

【URL】

https://veriteworks.co.jp/ (コーポレートサイト)

https://principle-works.jp/ (Magentoサービスページ)

https://www.verite-office.jp/(カウンセリングサービスサイト)

【事業内容】

情報システム開発サービス

メンタルヘルス ・ キャリアカウンセリングおよび関連サービス

労務相談、給与計算・人事制度構築コンサルティング / アウトソーシングサービス

【所在地】

〒114-0013 東京都北区東田端2-5-14 クロコダイル第2ビル5F

「株式会社ネットプロテクションズ」について

商号 :株式会社ネットプロテクションズ

(株式会社ネットプロテクションズホールディングス(東証プライム、証券コード7383)グループ)

代表者 :代表取締役社長 柴田 紳

URL :https://corp.netprotections.com/

事業内容 :後払い決済サービス各種

創業 :2000年1月

資本金 :1億円

所在地 :東京都千代田区麹町4丁目2-6 住友不動産麹町ファーストビル5階