Common Interface provided by Net Protections, Inc. (headquartered in Chiyoda-ku, Tokyo; CEO: Shin Shibata; “Net Protections'') is now connected with Magento Open Source, an e-commerce platform promoted by Veriteworks, Inc (headquartered in Kita-ku, Tokyo; President: Momoko Asaka; "Veriteworks"), along with Adobe Commerce*1 provided by Adobe (Nasdaq: ADBE) (headquartered in San Jose, California) and have started full scale operations.

*1 Adobe Commerce is one of the Adobe Experience Cloud’s solutions

What is Common Interface?

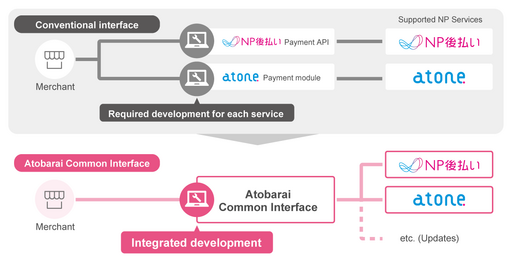

Common Interface is NP Atobarai and atone’s new system.

Net Protections’ BNPL services required a system development for each service, but Common Interface allows merchants to use both NP Atobarai and atone with a single system development.

Businesses and partner companies that could not introduce NP Atobarai and atone due to system development workload issues are now able to introduce NP Atobarai and atone with much less workload.

In addition to simplifying the system, the new system also improves the various values of the service.

Veriteworks has been providing NP Atobarai and atone as separate extensions for both Magento and Adobe Commerce, which are used by a wide range of customers and purposes, including cross-border e-commerce, global expansion, multi-brand stores, and hybrid BtoC and BtoB websites. Now NP Atobarai and atone can be connected with one extension.

How to use with Magento

Common Interface with Magento uses extensions provided by Veriteworks.

Extensions can be purchased from the following:

・https://principle-works.jp/m2-np-postpay-atone

*A separate application for NP Atobarai and atone is required.

・NP Atobarai:https://www.netprotections.com/inquiry/application/input/

・atone:https://atone.be/contact/ec/application/input/

Value proposition of Common Interface

①Improved NP Atobarai service quality

The following benefits can be enjoyed by connecting to the Common Interface. In addition, it will be possible to access other future updates.

①-1. Improve accuracy of credit screening and reduce risk of brand damage

In the current credit screening process, there are cases of fraud that cannot be detected with address, name and phone number only. There are also cases of transactions that could have been approved with additional information. Additional information (IP address, device information, etc.) can be obtained and authenticated using atone’s existing functions with Common Interface, thereby improving fraud detection, reducing risk of brand damage due to fraudulent resale, and eventually achieving higher approval rate.

①-2. Reduce respond time to pending transactions and prevent cart abandonment

When a pending transaction is put on hold due to incomplete information or other reasons, the merchant is required to confirm the information with the buyer after the transaction is completed in the current system. Common Interface’s modal display*2 allows customers to take action on the pending review during the shopping process, reducing the merchant’s workloads, and decreasing cart abandonment rate.

*2 A system that displays a pop-up window on the payment screen to show designated messages or ask customers to enter additional information

①-3. Reduce inquiries about rejection reasons

With the current system it was not possible to directly communicate with customers regarding the reasons why their purchase was declined, and in some cases, inquiries were directed to the merchant. Real-time credit screening and modal display will be available in the Common Interface, which enables the rejection reason display and inquiries, thereby reducing the response time and workload on merchants.

②Simplified access to atone’s 6 million members base

Common Interface makes atone introduction easier. The following benefits can be enjoyed by connecting to the Common Interface.

②-1. Encourage repeat purchase for first-time customers

The reward points program encourages repeat purchase of first-time customers who paid with NP Atobarai. Also, registering a bank account with atone will automate payments and improve retention rate.

②-2. Acquire new customers by transferring customers

Sales promotions and discount coupon offerings can be conducted to the over 6 million existing NP members*3. This creates an opportunity to attract a unique customer segment that prefers BNPL over credit cards.

*3 As of March 31, 2023

Features of atone

①No matter how many times you make purchases, only a single payment is required in the following month

atone supports bill consolidation and payment in the following month like a credit card, even if multiple purchases are made within a month, thus minimizing payment hassles.

②The only BNPL that has a reward points program

Users can earn points that can be used for discounts on their next purchase.

③Various payment methods

Users can choose their preferred payment methods such as CVS payment, wire transfer, direct debit, and LINE Pay.

About NP Atobarai

NP Atobarai is a Buy Now Pay Later (BNPL) service for BtoC e-commerce. It yearly processes transactions over JPY 374.6 billion with more than 15 million unique users*4. 1 in 7 people in Japan use NP Atobarai*5. Customers can make a purchase and pay later without credit cards, so customers can enjoy shopping without any risk. On the other hand, merchants can satisfy their demand for BNPL that takes up 20% of online shopping*6 and expect sales growth without fraud risks.

For more information about NP Atobara:https://www.netprotections.com/

*4 The number of users as of April 1, 2021 ~ March 31, 2022 with both name and phone number matching

*5 Calculated based on a population of 110.6 million aged 15 and over (estimated by Statistics Bureau, Ministry of Internal Affairs and Communications as of March 1, 2022) divided by 15 million annual unique users in the fiscal year ended March 31, 2022

*6 Based on our research

About atone

atone is a smartphone BNPL service for both online and offline stores. Users can make purchases immediately and pay later without registering a bank account, credit card, or adding funds. On the other hand, atone merchants can prevent cart abandonment which customers leave the site without completing their purchase. In offline stores, atone can contribute to cashless without losing customers who own credit cards but do not use them. The reward points program makes new acquisition and repeat purchases much easier.

For further information regarding atone:https://atone.be/(Japanese Only)

About Magento

Magento, released in 2008, is one of the world's three major e-commerce platforms. It is highly regarded in Europe, where a variety of regulations, market needs, and languages exist, and has gained a large user base for its rich functionality, robust and flexible architecture, and high performance, as well as its multilingual and multi currency support. There are many third-party extensions and themes that have passed strict quality standards, which can be combined to build high-quality websites in a short period of time. There are three editions of Magento: Magento Open Source, a free open source version; Magento Commerce, a paid version for larger websites with more advanced features; and Magento Commerce Cloud, which includes cloud hosting services. The paid version was acquired by Adobe and branded Adobe Commerce in April 2021.

For the editions comparison:https://principle-works.jp/about-magento/editions

Overview of Veriteworks, Inc.

Veriteworks provides services for people (counseling) and products (information systems) to improve the relationship between organizations and the employees. As a pillar of the information system development business, it specializes in Magento, an e-commerce platform developed in the U.S. that is currently used in more than 250,000 websites around the world. It also develops various extensions, builds e-commerce websites, and provides maintenance support while localizing for the Japanese market.

【Company Name】

Veriteworks Inc.

【Representative】

Momoko Asaka, President

【Website】

https://veriteworks.co.jp/(official website)

https://principle-works.jp/ (service page for Magento)

https://www.verite-office.jp/(service page for counseling service)

【Business Description】

Information system development services

Mental health/career counseling and related services

Labor consultation, payroll calculation and HR system consulting/outsourcing services

【Head office

】

Crocodile No.2 Building 5F, 2-5-14 Higashi-Tabata, Kita-ku, Tokyo 114-0013, Japan

Overview of Net Protections, Inc.

Company Name: Net Protections, Inc.

(Net Protections Holdings, Inc. [Code: 7383, the Prime Market of the Tokyo Stock Exchange] Group)

Representative: Shin Shibata, CEO

Website :https://corp.netprotections.com/

Business Description: Provision of Buy Now Pay Later (BNPL) services

Founded: January, 2000

Capital: JPY 100 million

Head Office: Sumitomo Fudosan Kojimachi First Building 5th Floor, 4-2-6 Kojimachi, Chiyoda-ku, Tokyo 102-0083, Japan