Subsidiary of Net Protections, Inc. (Headquartered in Chiyoda-ku, Tokyo; CEO: Shin Shibata; “Net Protections”), NP Finance, Inc. ("NP Finance"), will launch the online lending service, NP Handy Lending on October 23, 2024. This service will be available to select small and medium-sized enterprises (SMEs) and sole proprietors of NP Kakebarai.

.png)

About NP Handy Lending

NP Handy Lending is a new lending service that allows users to borrow funds online. No paper documents are required, and the application process can be completed entirely online, with funds being deposited in as little as three business days. This easy and fast method of securing funds is designed to support business growth and help companies focus on expanding their operations.

Service URL:https://np-handylending.com/

Background for launching the service

There are numerous funding options available to businesses, including bank loans and factoring. However, traditional financing methods often require extensive document preparation and submission, followed by weeks-long reviews based on credit history and performance evaluations. This process can be time-consuming and labor-intensive for businesses with limited resources to dedicate to funding acquisition.

With NP Handy Lending, the lending review process leverages the purchasing and payment data from NP Kakebarai which holds the No.1 market share in the BtoB payment industry*1 and has a broad track record. This allows for a much simpler and faster lending process compared to conventional financial institutions.

For SMEs and sole proprietors with limited time and resources to spend on securing funds, this service is designed to relieve them from the complexities of traditional financing, enabling them to focus on their core business operations.

.png)

Future Prospect

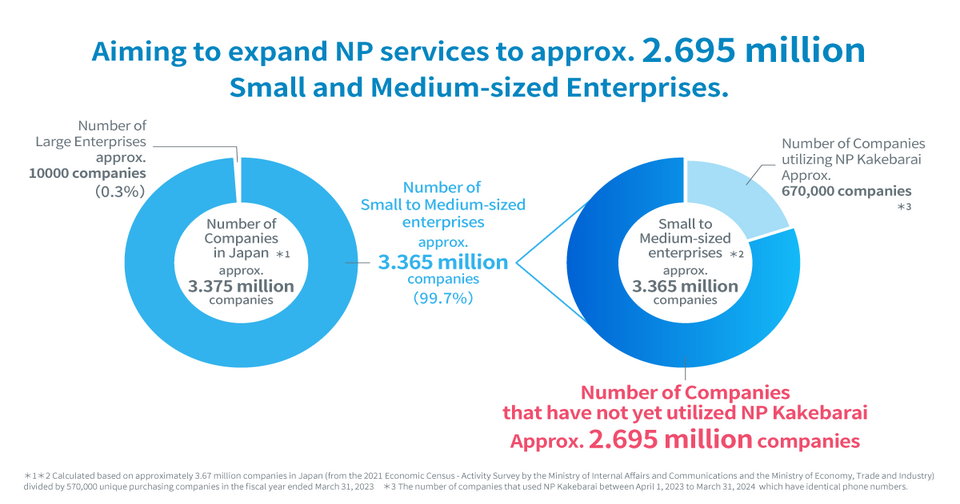

For the time being, we will be providing NP Handy Lending to business that use NP Kakebarai, but in the future, we aim to expand the scope of it with a particular focus on SMEs, which make up the majority of businesses in Japan.

We will provide SMES that have had difficulty obtaining loans using conventional credit methods with a safe and convenient means of financing that does not involve credit risk, and we aim to contribute to the revitalization of economic activity.

(*1) According to the “MIC IT Report, October 2022 issue, BtoB Payment Agency Service Market Survey (https://mic-r.co.jp/micit/2022/)” by Deloitte Tohmatsu MIC Economic Research Institute, the annual transaction volume for 2021 )」

About NP Finance, Inc.

Company Name :

NP Finance, Inc.

Representative :

Ryo Kasai

Founded :

April, 2024

Capital :

JPY 100 million

Shareholder :

Net Protections, Inc.

Head Office :

4-2-6 Kojimachi, Chiyoda-ku, Tokyo 102-0083, Japan

About Net Protections, Inc.

Company Name: Net Protections, Inc.

(Net Protections Holdings, Inc. [Code: 7383, the Prime Market of the Tokyo Stock Exchange] Group)

Representative: Shin Shibata, CEO

Website :https://corp.netprotections.com/

Business Description: Provision of Buy Now Pay Later (BNPL) services

Founded: January, 2000

Capital: JPY 100 million

Head Office: Sumitomo Fudosan Kojimachi First Building 5th Floor, 4-2-6 Kojimachi, Chiyoda-ku, Tokyo 102-0083, Japan