Net Protections, Inc. (Headquartered in Chiyoda-ku, Tokyo; CEO: Shin Shibata, “Net Protections”) has started offering NP Kakebarai for Salesforce, a service that links business and customer information managed by Salesforce, a CRM platform, with NP Kakebarai, a Buy Now Pay Later (BNPL) service for BtoB.

About NP Kakebarai for Salesforce

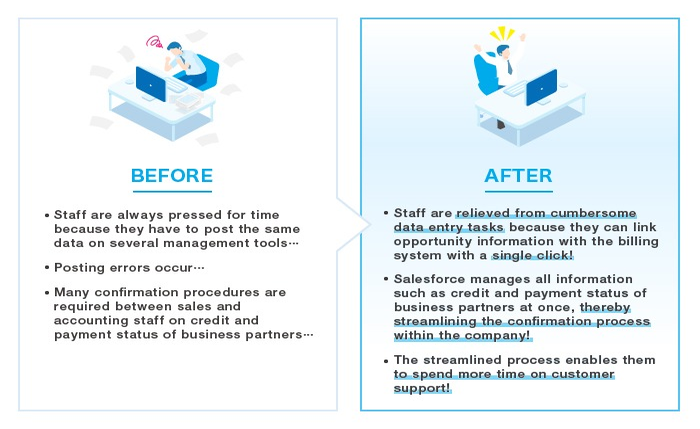

NP Kakebarai for Salesforce is a service that enables seamless management of information on Salesforce, ranging from opportunity management, credit screening, invoicing, collection, payment confirmation, and payment reminding by linking the NP Kakebarai system with Salesforce. Opportunity information on Salesforce can be linked to NP Kakebarai with a single click.

<Direct any inquiries regarding this service to>

https://np-kakebarai.com/contactus/form-b/(Japanese Only)

【Features】

Background to Service Development

Salespersons undertake various tasks in their business activities. For example, communicating on internal applications, etc. of business partners’ credit screening and invoices, and following up on delayed or non-payment. NP`s 2017 survey (※1) shows approximately 20 business days are annually spent on billing-related tasks with such costs difficult to track down, and highly stressful. To radically resolve the issue that salespersons spend much time on billing-related tasks rather than focusing on what they should do, NP has started offering “NP Kakebarai for Salesforce.” Salespersons can engage more with customers by delivering seamless operations from opportunity management, invoicing, to payment collection. NP will further collaborate with business partners such as DX solution providers, to keep supporting the challenges and growth of corporate entities.

※1)Net Protections, Inc. “Fact-finding survey on payment operations”:https://np-kakebarai.com/content/work_style_reform_1/(Japanese Only)

About NP Kakebarai

B2B payment on credit service ‘'NP Kakebarai" diversifies risks through small claims and eliminates unnecessary operations by working between the merchant (seller) and their client (buyer) to perform account receivable procedure and billing operations from credit scoring for buyer to issuing invoice, collecting and confirming buyer’s payment, with 100% guarantee against the risk of bad debt.

With NP Kakebarai, seller can digitize all the operations of account receivable procedures, eliminate unnecessary operations and boost productivity while reducing the amount of bad debt to achieve management stability. Additionally, with the unique credit scoring model that doesn't rely on traditional credit bureaus, NP Kakebarai is able to offer precise and suitable credit scoring results of buyer which helps growing the seller’s business and increasing sales. Buyer can improve cash flow with the flexibility to be able to complete the payment later.

As of 2021, NP Kakebarai has annual transaction of 75 billion JPY, used by more than 410,000 companies, as 1 out of 8 companies in Japan chose NP Kakebarai as payment method(※2). On the road ahead, NP Kakebarai is dedicated to providing service to build a sustainable world in which all stakeholders are empowered to thrive and grow.

For further information regarding NP Kakebarai:https://np-kakebarai.com/(Japanese Only)

※2)Based on “Report of the 2019 Basic Survey on Small and Medium-sized Enterprises“ which estimated the number of Japan enterprise to 3.59 million and the number of companies using NP Kakebarai (410,000).

About Net Protections, Inc.

Net Protections, Inc. is a pioneer company in Buy Now Pay Later (BNPL) services in Japan and is leading the market with the largest market share (※3). In 2002, Net Protections launched its first service, NP Atobarai, a BNPL that guarantees risk-free transactions for businesses and provides a deferred payment for customers in Japan for the first time. In FY2020, NP Atobarai’s annual transaction volume has hit the growth rate of 116% compared to the previous fiscal year. NP Atobarai is used by numerous enterprises with over 15.8 million unique users in Japan (※4) and has processed more than 280 million transactions to date. In 2011, Net Protections released NP Kakebarai, a BNPL service for BtoB. NP Kakebarai has grown 127% yearly and played a role as the dominant BtoB payment service in Japan. In 2017, Net Protections launched atone, BtoC BNPL service with membership benefits that offers better shopping experience. In 2018, Net Protections released AFTEE, BtoC BNPL service in Taiwan. Net Protections has accumulated transaction data and knowledge since its first service launched, which has enabled it to build a sophisticated credit screening syste

【Company Name】

Net Protections, Inc.

【CEO】

Shin Shibata

【Website】

https://corp.netprotections.com/

【Business Outline】

BtoC E-Commerce BNPL Payment Service “NP Atobarai”(”Buy Now Pay Later (BNPL)” Service)

BtoB BNPL Payment Service “NP Kakebarai”

BtoC BNPL Payment Service “NP Atobarai air” for day-to-day services

BtoC BNPL Payment Service with membership benefits “atone”

BtoC BNPL Payment Service in Taiwan “AFTEE”

Point Reward Program: NP Point Club

【Founded】

January, 2000

【Capital】

JPY 100 million

【Headquarter】

SUMITOMO FUDOSAN KOJIMACHI FIRST BUILDING 5F, 4-2-6 Kojimachi, Chiyoda-ku, Tokyo 102-0083 Japan

※3)Calculated based on the estimated size of BNPL market in Japan of JPY882 billion in FY2020 and the aggregate of GMV of NP Atobarai and atone in FY2020 of JPY360 billion. The estimated size of BNPL market in Japan is provided from Yano Research Institute “Online Payment/Settlement Service Providers 2021”

※4)The number of individual unique users of NP Atobarai based on the matching of duplicative names and phone numbers during FY3/2021 (April 1, 2020 to March 31, 2021).

Direct any inquiries regarding this release to:

Net Protections PR

MAIL :pr@netprotections.co.jp