Net Protections, Inc. (headquartered in Chiyoda-ku, Tokyo; CEO: Shin Shibata; “Net Protections”) announces the policy for its BtoB Buy Now Pay Later (BNPL) service, NP Kakebarai, in response to the new qualified invoice system that will come into effect in Japan in October 2023.

NP Kakebarai’s policy regarding new qualified invoice system in Japan

In preparation for the launch of the new invoice system, Net Protections is pleased to announce that NP Kakebarai will be fully compatible with the new system so that member stores can continue to use our services with peace of mind. We are moving forward with the development of new functions in order to issue invoices that meet all the requirements of qualified invoices.

By enabling Net Protections to issue qualified invoices, NP Kakebarai member stores will be spared the burden of altering invoice specifications to comply with the new invoice system and saving copies of the qualified invoices.

<Qualified invoice requirements>

1. Qualified invoice issuer name or title and registration number

2. Date of transaction

3. Details of transaction (separate description required for transactions subject to reduced Japanese consumption tax rates)

4. Total amount (consumption tax inclusive or exclusive) and the relevant tax rate

5. Total consumption tax amount by tax rate (one rounding per tax rate per qualified invoice)

6. Name or title of business entity receiving the invoice

About the qualified invoice system (※1)

The new qualified invoice system will be implemented in Japan on October 1, 2023. When a seller (invoicing party) registers as a qualified invoice issuer and issues an invoice that meets the requirements of the new system, the buyer (recipient of invoice) is eligible for purchase tax credit.

Failure to comply with the new invoice system may result in the buyer not being able to recover purchase tax credit, and therefore compliance with the system is recommended.

(※1) For more details and the latest information on the new invoice system, see the website of the National Tax Agency below.

https://www.nta.go.jp/taxes/shiraberu/zeimokubetsu/shohi/keigenzeiritsu/invoice.htm(Japanese Only)

About NP Kakebarai

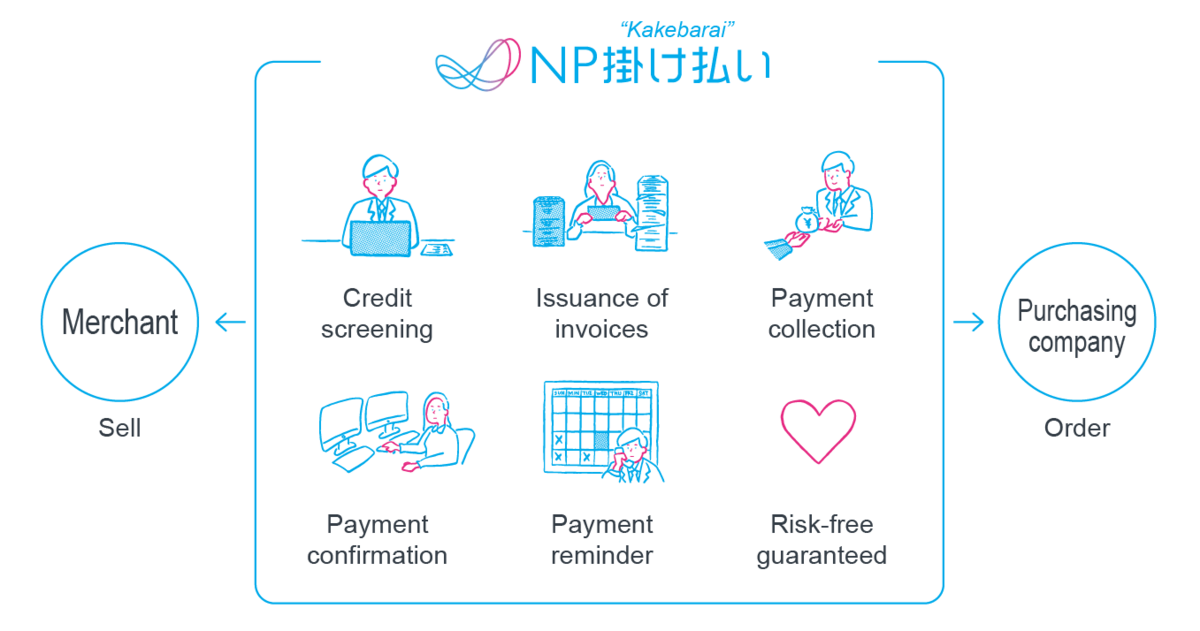

NP Kakebarai is a BtoB Buy Now Pay Later (BNPL) service that guarantees risk-free transactions and enables to reduce the complicated billing/payment process between merchants and their clients through credit screening, billing, collection, payment confirmation, and payment reminder. With NP Kakebarai, businesses can outsource and digitally transform the whole billing process, thus it is able to reduce unnecessary operations and boost productivity. In addition, NP Kakebarai's sophisticated credit screening system which does not rely on the traditional Credit Bureau, accurately detects delinquency risk while maintaining 99% approval rate (※2), thus merchants can easily handle SMEs, even individual businesses while preventing risks. Therefore, it contributes to merchants’ sales increase and market expansion, also improvement of cash flow for clients for its flexible payment deadline. As of 2022, NP Kakebarai's annual transaction volume is JPY 97.9 billion, and 460,000 companies, or one out of every eight companies in Japan, use the service annually (※3). NP Kakebarai will continue to contribute to an environment in which all stakeholders can more freely take on challenges and grow by providing services that appropriately comply with the legal system, support operational efficiency, promote digital transformation, and boost business growth of the customers who use its services.

For further information regarding NP Kakebarai: https://np-kakebarai.com(Japanese Only)

※2) As of March 31, 2022

※3) Based on “Report of the 2019 Basic Survey on Small and Medium-sized Enterprises“ which estimated the number of Japan enterprise to 3.59 million and the number of companies using NP Kakebarai

About Net Protections, Inc.

Net Protections, Inc. is a pioneer of Buy Now Pay Later (BNPL) services in Japan. In 2002, Net Protections launched its first service, NP Atobarai, a BNPL that guarantees risk-free transactions for businesses and provides a deferred payment for customers in Japan for the first time. NP Atobarai is used by numerous enterprises with over 15 million users (※4) and has surpassed 340 million transactions as of March, 2022. In 2011, Net Protections released NP Kakebarai, a BNPL service for BtoB. NP Kakebarai has grown 130% yearly and played a role as the dominant BtoB payment service in Japan. In 2017, Net Protections launched atone, BtoC BNPL service that can be used at not only e-commerce, but also digital content and physical retailers. In 2018, Net Protections released AFTEE, BtoC BNPL service in Taiwan. Net Protections has accumulated transaction data and knowledge since its first service launched, which has enabled it to build a sophisticated credit screening system and solid operation skills. Net Protections always pursues creating a society where everyone can do business safely and easily.

【Company Name】

Net Protections, Inc.

(Net Protections Holdings, Inc.[Code: 7383, Prime Market of Tokyo Stock Exchange] Group)

【Representative】

Shin Shibata, CEO

【Website】

https://corp.netprotections.com/en/

【Services】

BtoC e-commerce Buy Now Pay Later (BNPL) service, NP Atobarai

BtoB BNPL Service, NP Kakebarai

BtoC BNPL service for on-site services, NP Atobarai air

BtoC cardless BNPL service, atone

BtoC BNPL Service in Taiwan, AFTEE

Point reward program, NP Point Club

【Founded】

January, 2000

【Capital】

JPY 100 million

【Head Office】

SUMITOMO FUDOSAN KOJIMACHI FIRST BUILDING 5F, 4-2-6 Kojimachi, Chiyoda-ku, Tokyo 102-0083 Japan

※4)The number of individual unique users of NP Atobarai based on the matching of duplicative names and phone numbers between April 1, 2021 to March 31, 2022

Direct any inquiries regarding this release to:

Net Protections PR

Email: pr@netprotections.co.jp