Net Protections, Inc. (headquartered in Chiyoda-ku, Tokyo; CEO: Shin Shibata; “Net Protections”) is pleased to announce that its BtoB BNPL service, NP Kakebarai, is available for use in transactions on the PIXTA marketplace (https://www.pixtastock.com/) for photographs, illustrations, videos, and music operated by PIXTA Inc. (headquartered in Shibuya-ku, Tokyo; CEO: Daisuke Komata; “PIXTA”) as of October 2022.

Background behind introduction

PIXTA is a digital marketplace that allows both professionals and amateurs alike to sell their photographs, illustrations, videos, and music online. Up until now, PIXTA has mailed paper invoices to companies wishing to pay by invoice. However, as work styles have changed post COVID-19, there has been increasing demand among corporate users for paperless invoices.

By introducing NP Kakebarai, PIXTA will be able to address demand for paperless invoices from its corporate users, and by outsourcing its payment services, it will be able to better focus its resources on developing and improving its essential services such as operation of the PIXTA website without having to use them on development costs associated with responding to changes in the law and upgrading payment functions to keep up with the times. These advantages led PIXTA to introduce NP Kakebarai.

Reasons why PIXTA chose NP Kakebarai

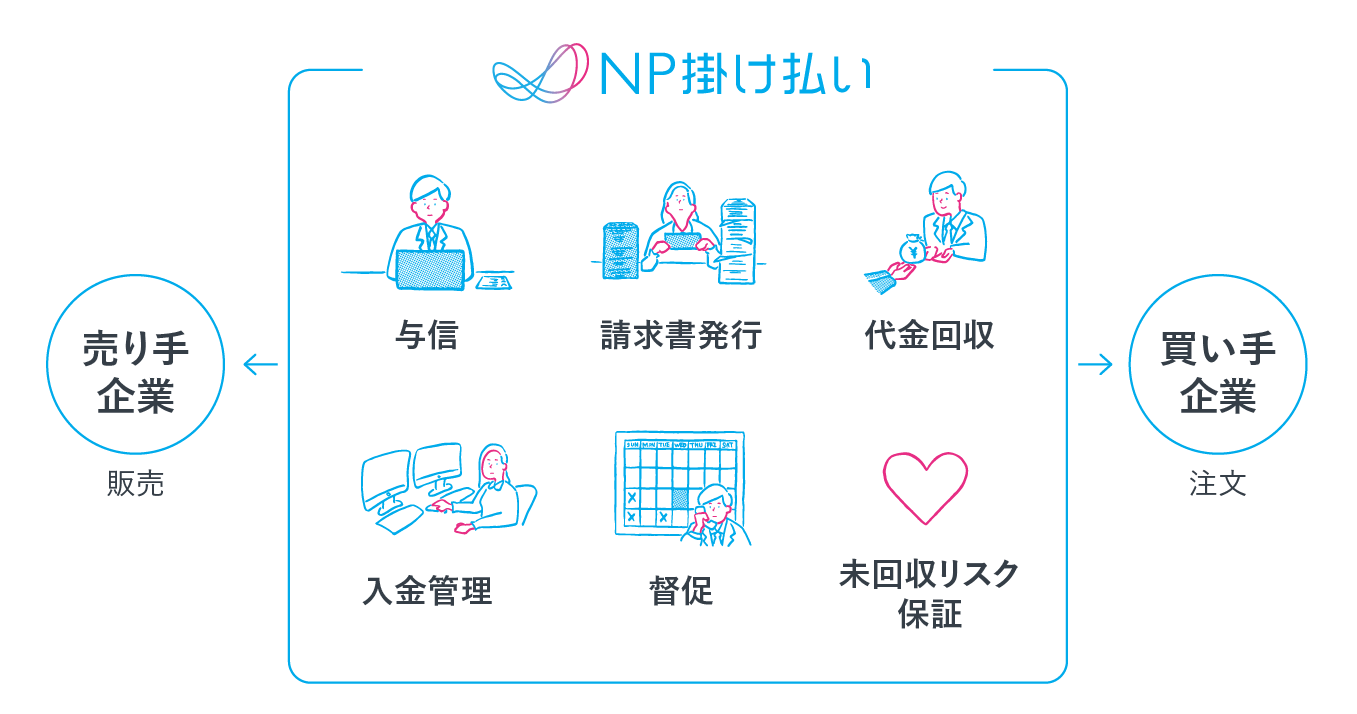

NP Kakebarai is a service that allows companies to outsource all payment processes related to BtoB transactions. PIXTA decided to introduce NP Kakebarai based on the benefits below.

(1) Payment flow corresponding to the needs of corporate users

NP Kakebarai is a payment service that does not require the submission of any paper documents to use. In addition, corporate users can receive their invoices via email, which enables paperless billing operations. Furthermore, payments can be made by bank transfer or direct debit for a payment flow that suits the needs of the business customer.

(2) Outsource a broad range of process

NP Kakebarai not only handles the issuance of invoices but also everything from credit screening to payment confirmation, payment reminders, and accounts receivable guarantees, which means that even if the transaction volume increases, PIXTA’s workload related to payments will not. By outsourcing payment operations, which are a routine operation with no room for mistakes, PIXTA will be able to focus its resources instead on developing and improving its essential services.

Net Protections will continue to work on improving the services we offer and provide support to corporate customers promoting digital transformation.

About PIXTA

Launched in May 2006, PIXTA is a digital marketplace that allows both professionals and amateurs alike to sell their photographs, illustrations, videos, and music online. Its extensive selection of images, videos, and music to support creativity in all kinds of genres and media makes it popular among people in the creative production field, especially in Japan.

PIXTA URL:https://www.pixtastock.com/

【Company Name】

PIXTA Inc. (Code: 3416, the Growth Market of the Tokyo Stock Exchange)

Founded:August 25, 2005

Head Office:NBF Shibuya East 7th floor, 3-3-5 Shibuya, Shibuya-ku, Tokyo, Japan

TEL:+81-3-5774-2692 FAX:+81-3-5774-2695 Website:https://pixta.co.jp/en

Capital:JPY 325,777,000 (as of June 30, 2022)

Representative:Daisuke Komata, CEO

Services:Online marketplace for digital content, PIXTA. Location shooting and photographer service for businesses, PIXTA On Demand. Location shooting matching service for families with children, fotowa.

Subsidiaries:Snapmart Inc. PIXTA Asia Pte. Ltd. PIXTA Vietnam Co., Ltd.

About NP Kakebarai

NP Kakebarai is a BtoB Buy Now Pay Later (BNPL) service that guarantees risk-free transactions and enables to reduce the complicated billing/payment process between merchants and their clients through credit screening, billing, collection, payment confirmation, and payment reminder. With NP Kakebarai, businesses can outsource and digitally transform the whole billing process, thus it is able to reduce unnecessary operations and boost productivity. In addition, NP Kakebarai's sophisticated credit screening system which does not rely on the traditional Credit Bureau, accurately detects delinquency risk while maintaining 99% approval rate (※2), thus merchants can easily handle SMEs, even individual businesses while preventing risks. Therefore, it contributes to merchants’ sales increase and market expansion, also improvement of cash flow for clients for its flexible payment deadline. As of 2022, NP Kakebarai's annual transaction volume is JPY 97.9 billion, and 460,000 companies, or one out of every eight companies in Japan, use the service annually (※3). NP Kakebarai will continue to contribute to an environment in which all stakeholders can more freely take on challenges and grow by providing services that appropriately comply with the legal system, support operational efficiency, promote digital transformation, and boost business growth of the customers who use its services.

For further information regarding NP Kakebarai: https://np-kakebarai.com/(Japanese Only)

*1: As of March 31, 2022

*2: Based on “Report of the 2019 Basic Survey on Small and Medium-sized Enterprises"" which estimated the number of Japan enterprise to 3.85 million and the number of companies using NP Kakebarai

About Net Protections, Inc.

Net Protections, Inc. is a pioneer of Buy Now Pay Later (BNPL) services in Japan. In 2002, Net Protections launched its first service, NP Atobarai, a BNPL that guarantees risk-free transactions for businesses and provides a deferred payment for customers in Japan for the first time. NP Atobarai is used by numerous enterprises with over 15 million users (※3) and has surpassed 340 million transactions as of March, 2022. In 2011, Net Protections released NP Kakebarai, a BNPL service for BtoB. NP Kakebarai has grown 130% yearly and played a role as the dominant BtoB payment service in Japan. In 2017, Net Protections launched atone, BtoC BNPL service that can be used at not only e-commerce, but also digital content and physical retailers. In 2018, Net Protections released AFTEE, BtoC BNPL service in Taiwan. Net Protections has accumulated transaction data and knowledge since its first service launched, which has enabled it to build a sophisticated credit screening system and solid operation skills. Net Protections always pursues creating a society where everyone can do business safely and easily.

【商号】

株式会社ネットプロテクションズ

(株式会社ネットプロテクションズホールディングス(東証プライム、証券コード7383)グループ)

【代表者】

代表取締役社長 柴田 紳

【URL】

https://corp.netprotections.com/

【事業内容】

後払い決済サービス「NP後払い」の運営

企業間決済サービス「NP掛け払い」の運営

訪問サービス向け後払い決済サービス「NP後払いair」の運営

新しいカードレス決済「atone(アトネ)」の運営

台湾 スマホ後払い決済「AFTEE(アフティー)」の運営

ポイントプログラムの運営

【創業】

2000年1月

【資本金】

1億円

【所在地】

〒102-0083 東京都千代田区麹町4丁目2-6 住友不動産麹町ファーストビル5階

※3)The number of individual unique users of NP Atobarai based on the matching of duplicative names and phone numbers between April 1, 2021 to March 31, 2022

Direct any inquiries regarding this release to:

Net Protections PR

Email: pr@netprotections.co.jp