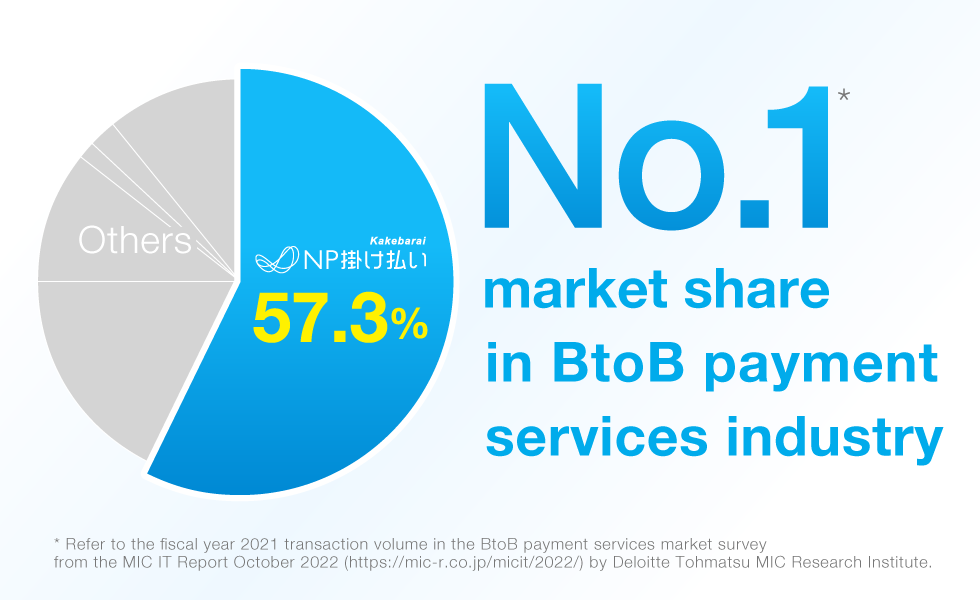

Net Protections, Inc. (headquartered in Chiyoda-ku, Tokyo; CEO: Shin Shibata; “Net Protections”) is pleased to announce that its BtoB BNPL service NP Kakebarai captured the top share*1 of the transaction volume in the BtoB payment services industry in fiscal year 2021 according to the research of the BtoB payment services market survey from the MIC IT Report October 2022 by Deloitte Tohmatsu MIC Research Institute Co., Ltd.

*1. Refer to the fiscal year 2021 transaction volume in the BtoB payment services market survey from the MIC IT Report October 2022 (https://mic-r.co.jp/micit/2022/) by Deloitte Tohmatsu MIC Research Institute.

About BtoB payment services

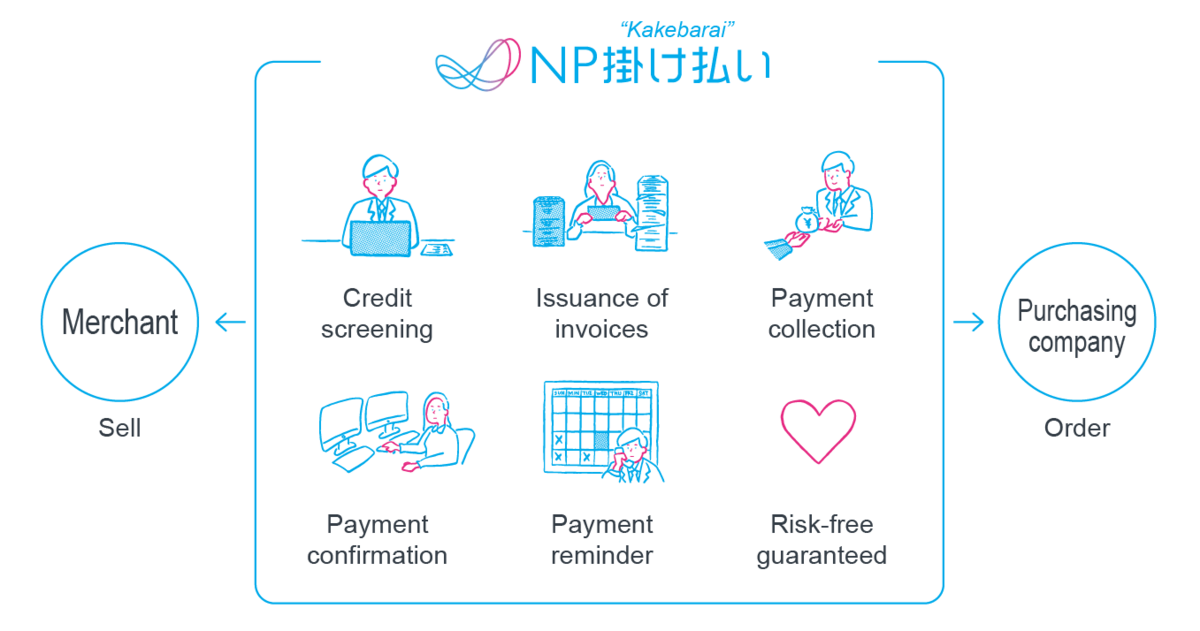

BtoB payment services as defined in this survey refer to billing services that guarantee risk-free transactions and cover from credit screening to invoice issuance, collection, payment confirmation, and payment reminders. This differs from services that consist only of issuing invoices in response to orders placed by customers.

Overview of BtoB payment services market

The environment surrounding BtoB payments has changed drastically over the past several years due to changes in work styles, legal revisions, and other factors.

Specifically, there is an increasing demand for BtoB payment services that guarantee against non-payment risk due to the increased risk of bankruptcy among trading partners caused by the COVID-19 pandemic. In addition, as remote work and hybrid office/remote work become more common, coming to the office to issue or receive paper invoices is becoming a challenge for more and more companies. Furthermore, business operators are being forced to take action to comply with the new qualified invoice system, which will be implemented in October 2023.

BtoB payment services can give solutions to these changes in the environment. Companies can avoid non-payment risk, comply with the new qualified invoice system, and digitally transform their billing operations. This allows companies to concentrate on their core operations such as sales channel expansion. As such, the number of inquiries from corporate customers in the industry and the number of businesses entering the market*2 are currently on the rise, which means there is potential for significant growth going forward.

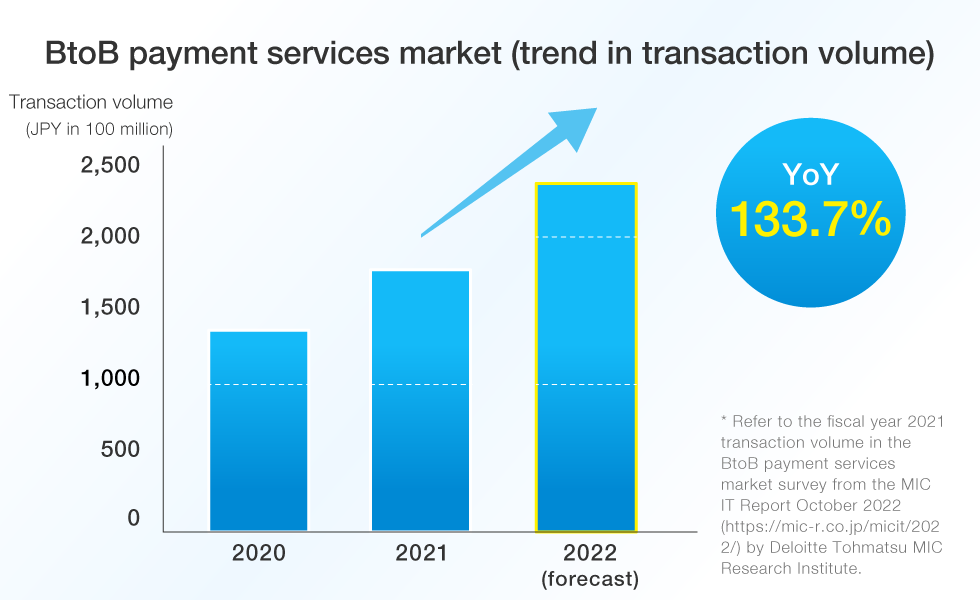

According to the MIC IT Report, in terms of the transaction volume in fiscal year 2021, the BtoB payment services market grew to JPY 169.7 billion, a 129.4% increase over the previous fiscal year. Taking into account growth of the businesses that entered the market in fiscal year 2021, the market is expected to grow to JPY 226.9 billion in fiscal year 2022, representing a remarkable 133.7% year-on-year increase.

*2. Domestic Fintech BtoB Payment Services Market Landscape in 2019 by Net Protections

https://np-kakebarai.com/news/n1856/(Japanese only)

About NP Kakebarai

NP Kakebarai is a BtoB Buy Now Pay Later (BNPL) service that guarantees risk-free transactions and streamlines the complicated billing/payment process between merchants and customers through credit screening, billing, collection, payment confirmation, and payment reminders. With NP Kakebarai, businesses can outsource and digitally transform the whole billing process, thus it is able to reduce unnecessary operations and boost productivity. In addition, NP Kakebarai's sophisticated credit screening system which does not rely on the traditional Credit Bureau, accurately detects delinquency risk while maintaining 99% approval rate*3, thus merchants can easily handle SMEs, even individual businesses while preventing risks. Therefore, it contributes to merchants’ sales increase and market expansion, also improvement of cash flow for clients for its flexible payment deadline. As of 2022, NP Kakebarai's annual transaction volume is JPY 97.9 billion, and 460,000 companies, or one out of every eight companies in Japan, use the service annually*4. NP Kakebarai will continue to contribute to an environment in which all stakeholders can more freely take on challenges and grow by providing services that appropriately comply with the legal system*5, support operational efficiency, promote digital transformation, and boost business growth of the customers who use its services.

For further information regarding NP Kakebarai: https://np-kakebarai.com/(Japanese only)

*3. As of March 31, 2022

*4. Based on “Report of the 2019 Basic Survey on Small and Medium-sized Enterprises” which estimated the number of Japan enterprise to 3.85 million and the number of companies using NP Kakebarai

*5. Net Protections Announces Policy for BtoB BNPL Service NP Kakebarai in Response to New Qualified Invoice System

https://np-kakebarai.com/news/20220816(Japanese only)

About Net Protections, Inc.

Net Protections, Inc. is a pioneer of Buy Now Pay Later (BNPL) services in Japan. In 2002, Net Protections launched its first service, NP Atobarai, a BNPL that guarantees risk-free transactions for businesses and provides a deferred payment for customers in Japan for the first time. NP Atobarai is used by numerous enterprises with over 15 million users (※6) and has surpassed 340 million transactions as of March, 2022. In 2011, Net Protections released NP Kakebarai, a BNPL service for BtoB. NP Kakebarai has grown 130% yearly and played a role as the dominant BtoB payment service in Japan. In 2017, Net Protections launched atone, BtoC BNPL service that can be used at not only e-commerce, but also digital content and physical retailers. In 2018, Net Protections released AFTEE, BtoC BNPL service in Taiwan. Net Protections has accumulated transaction data and knowledge since its first service launched, which has enabled it to build a sophisticated credit screening system and solid operation skills. Net Protections always pursues creating a society where everyone can do business safely and easily.

【Company Name】

Net Protections, Inc.

(Net Protections Holdings, Inc.[Code: 7383, Prime Market of Tokyo Stock Exchange] Group)

【Representative】

Shin Shibata, CEO

【Website】

https://corp.netprotections.com/en/

【Services】

BtoC e-commerce Buy Now Pay Later (BNPL) service, NP Atobarai

BtoB BNPL Service, NP Kakebarai

BtoC BNPL service for on-site services, NP Atobarai air

BtoC cardless BNPL service, atone

BtoC BNPL Service in Taiwan, AFTEE

Point reward program, NP Point Club

【Founded】

January, 2000

【Capital】

JPY 100 million

【Head Office】

SUMITOMO FUDOSAN KOJIMACHI FIRST BUILDING 5F, 4-2-6 Kojimachi, Chiyoda-ku, Tokyo 102-0083 Japan

※6)The number of individual unique users of NP Atobarai based on the matching of duplicative names and phone numbers between April 1, 2021 to March 31, 2022

Direct any inquiries regarding this release to:

Net Protections PR

Email: pr@netprotections.co.jp