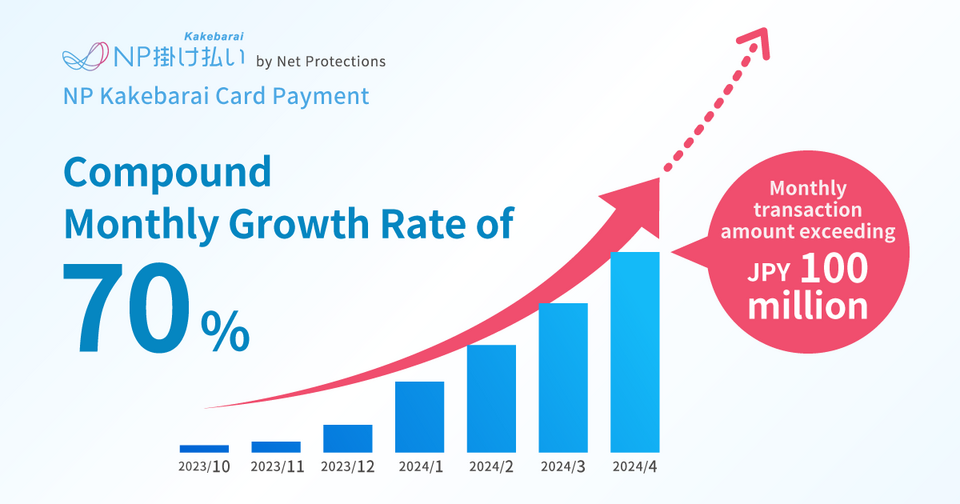

Net Protections, Inc. (headquartered in Chiyoda-ku, Tokyo; CEO: Shin Shibata; “Net Protections”) is pleased to announce that the monthly transaction volume of NP Kakebarai Credit Card Payment Service surpasses JPY 100 Million in April 2024.

Since the service launched in October 2023, the transaction volume of NP Kakebarai has been increasing at a monthly average growth rate of about 70%. Moreover, the number of companies signing up for the service has been growing by 1,000 companies per month.

Service Performance After Launch

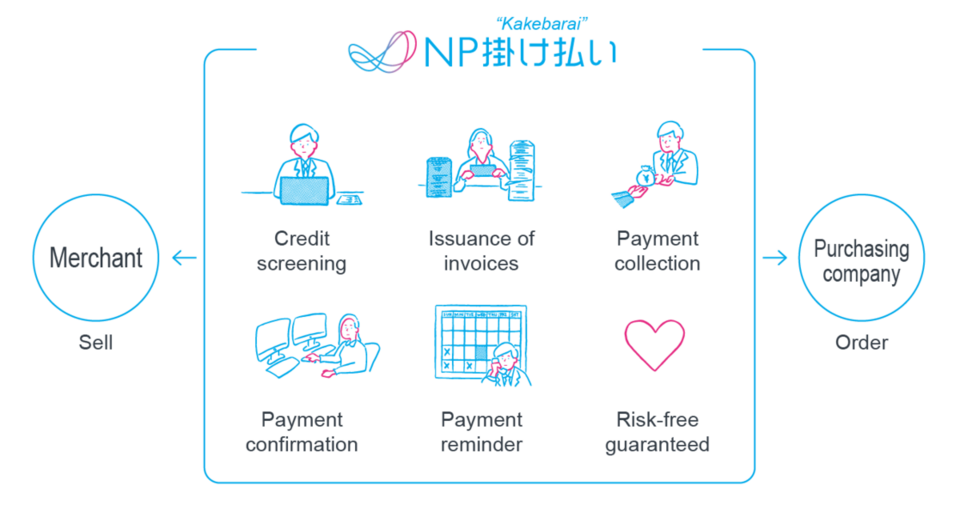

Since 2011, Net Protections has been offering NP Kakebarai, a BtoB BNPL service that handles all aspects of billing operations, from credit screening and invoice issuance to collection and payment reminders.

Net Protections has supported various businesses in streamlining their billing processes and contributing to their business growth.

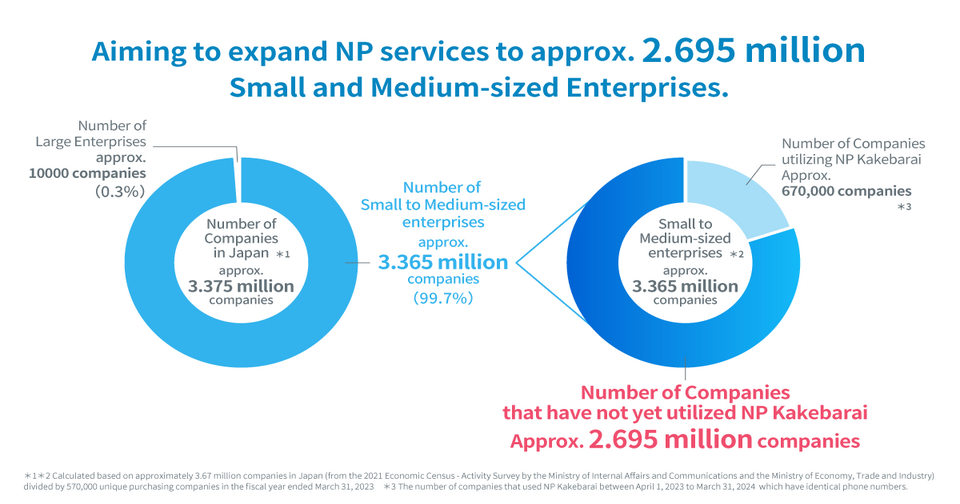

Currently, approximately 670,000 companies have used NP Kakebarai. Most of these companies are small to medium-sized enterprises (SMEs) or individual business owners who face significant challenges due to rising costs and labor shortages.

These companies struggle to allocate time for their core operations due to limited resources.

In particular, wholesalers and retailers, who constitute a large portion of our users, often face cash flow difficulties as they need to purchase goods before selling them.

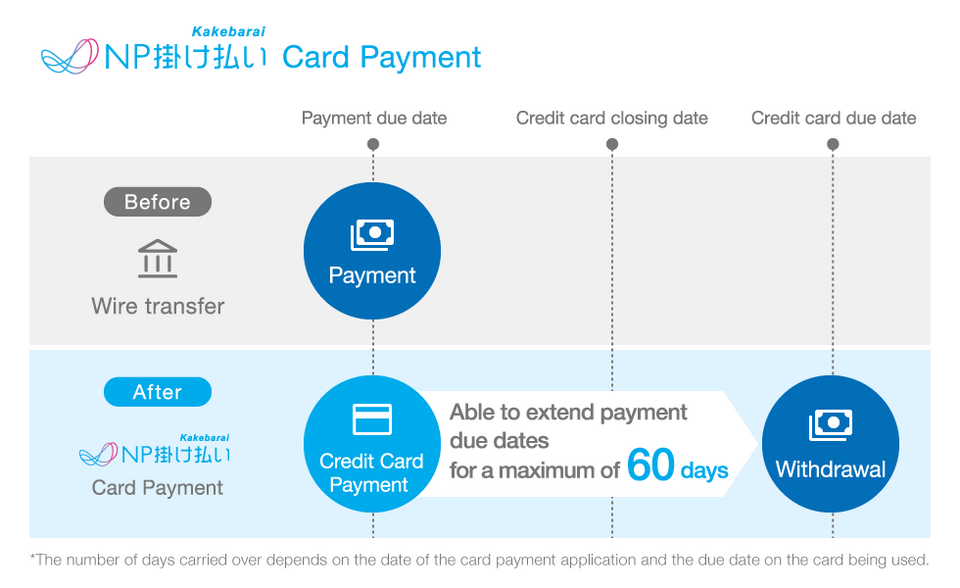

By utilizing NP Kakebarai Credit Card Payment Service, these companies can effectively extend their payment deadlines, thus improving their cash flow. The service does not require prior documentation submission, making it a more efficient alternative to loans or factoring services. This efficiency allows companies to focus more on their primary operations.

Future Outlook

As the working-age population declines and labor shortages worsen, the demand for NP Kakebarai Credit Card Payment Service is expected to rise. By expanding our service coverage to the approximately 3.38 million SMEs in Japan, we aim to further support their business growth.

As the leading company in the BtoB payment industry*1, Net Protections plans to leverage our accumulated data and expertise to add more payment functions and financial services beyond NP Kakebarai Card Payment Service.

These efforts will enhance the convenience of BtoB transactions, fostering an environment where all business stakeholders can freely challenge and grow.

※1) Based on our annual GMV for FY2021 from Deloitte Tohmatsu MIC Research Institute “MIC IT Report October 2022 – Survey on BtoB Payment Service Provider Market. (https://mic-r.co.jp/micit/2022/)

About NP Kakebarai Credit Card Payment Service

NP Kakebarai Credit Card Payment Service is a service that allows companies to pay invoices issued for BtoB transactions using their credit cards. This service effectively extends the payment deadline, improving the cash flow. Previously, invoices were paid through bank transfers or at convenience stores, but now possible to be integrated and paid with a credit card, enhancing operational efficiency. No prior documents are required; companies can start using the service with just their invoices and credit cards at hand. Requiring less advance preparation, makes it a more efficient alternative to other loans or factoring services.

Features

No need to submit financial statements or other documents. The service can be used from the next business day after registration.

When using a credit card, the payment deadline can be extended by up to 60 days (the deferral period varies depending on the card payment application date and the card's payment date). The service supports international payment networks such as JCB, Visa, and Mastercard

Users can not only track the progress of their payment application but also check past transactions and invoices.

For more details, visit: https://np-kakebarai.com/buyer-pay/invoice-card/

About NP Kakebarai

NP Kakebarai is a BtoB Buy Now Pay Later (BNPL) service that guarantees risk-free transactions and streamlines the complicated billing/payment process between merchants and customers through credit screening, billing, collection, payment confirmation, and payment reminders. With NP Kakebarai, businesses can outsource and digitally transform the whole billing process, thus it is able to reduce unnecessary operations and boost productivity. In addition, NP Kakebarai's sophisticated credit screening system which does not rely on the traditional Credit Bureau, accurately detects delinquency risk while maintaining 99% approval rate*3, thus merchants can easily handle SMEs, even individual businesses while preventing risks. Therefore, it contributes to merchants’ sales increase and market expansion, also improvement of cash flow for clients for its flexible payment deadline. As of 2023, NP Kakebarai's annual transaction volume is JPY 136.9 billion, and 670,000 companies, or one out of every six companies in Japan, use the service annually*4. NP Kakebarai will continue to be dedicated to providing the service creating a sustainable environment in which all stakeholders can challenge and grow more freely.

For more information about NP Kakebarai :https://np-kakebarai.com/ (Japanese only)

*2 As of March 31, 2023

*3 Calculated based on approximately 3.67 million companies in Japan (from the 2021 Economic Census - Activity Survey by the Ministry of Internal Affairs and Communications and the Ministry of Economy, Trade and Industry) divided by 570,000 unique purchasing companies in the fiscal year ended March 31, 2023

About Net Protections, Inc.

Company Name:

Net Protections, Inc.

(Net Protections Holdings, Inc. [Code: 7383, the Prime Market of the Tokyo Stock Exchange] Group)

Representative:

Shin Shibata, CEO

Website:

https://corp.netprotections.com/

Business Description:

Provision of Buy Now Pay Later (BNPL) services

Founded:

January, 2000

Capital:

JPY 100 million

Head Office:

Sumitomo Fudosan Kojimachi First Building 5th Floor, 4-2-6 Kojimachi, Chiyoda-ku, Tokyo 102-0083, Japan

Direct any inquiries regarding this release to:

Net Protections PR

Email: pr@netprotections.co.jp