Net Protections, Inc. (headquartered in Chiyoda-ku, Tokyo; CEO: Shin Shibata; "Net Protections") has joined a business alliance, App Unity, as an app partner. App Unity provides Shopify apps that are optimized for the online environment in Japan.

Following the recent listing of NP Atobarai and atone on the Shopify app store as official Shopify apps, Net Protections will accelerate its activity in support of sales for Shopify stores both in terms of acquisition of new customers and promotions for repeat purchases.

Net Protections is also currently offering a limited-time introduction campaign for Shopify stores.

Limited-time introduction campaign for Shopify stores

More about App Unity

App Unity is a business alliance that provides Shopify apps that are optimized for the online environment in Japan.

App Unity contributes to the development of the Japanese online environment surrounding Shopify through its activities, which include the development of new apps adapted to the Japanese e-commerce market environment, the development of purpose-specific solution packages, the standardization of the support system for Shopify apps, research into and elimination of interference between reciprocal apps and themes, and the proactive provision of information to the Shopify community.

For more details:https://appunity.jp/

The background of joining App Unity

Net Protections is a pioneer company in BNPL (Buy Now Pay Later) services in Japan and is leading the market with a market share of over 40%.

Net Protections takes pride in its role in revitalizing and strengthening the entire e-commerce industry, and has been looking to collaborate more closely on the growth of merchants (business operators) who develop e-commerce business using Shopify.

With the NP Atobarai and atone’s official approval as Shopify apps, Net Protections made a decision to join App Unity to further accelerate supporting sales growth for Shopify stores, both in terms of acquisition of new customers and promotions for repeat purchases.

Net Protections will provide comprehensive support to merchants (business operators), in collaboration with Shopify app providers.

Collaboration between Shopify and NP Atobarai / atone

Purchasing experience ends with making a payment, and offering more ways to pay that meet customers’ needs not only improves user convenience, but also leads to the acquisition of new customers and sales increase for e-commerce businesses. In particular, the demand for BNPL services is high in the Japanese marketplace, being the second most requested(*1) payment method after credit cards. BNPL is quickly replacing Cash on delivery, and this satisfies the demand of those who do not want to use credit cards for their first purchase on their first-time visiting websites.

Net Protections has partnered with Shopify since April 2022, so Shopify stores can easily introduce NP Atobarai and atone without any system development.

*1 Net Protections survey. An internet survey that targeted 2,065 people in their teens to their 50s across Japan, March 25 & 26, 2016

Net Protections’ strength in BNPL

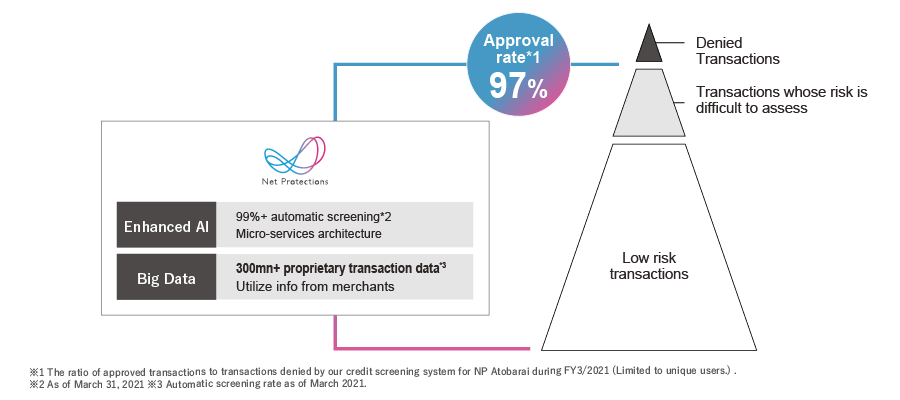

Solid contribution to boosting sales through sophisticated credit screening system

As the leading company in BNPL, Net Protections has a high reputation for its sophisticated credit screening model. If credit screening is too strict, the benefits of sales improvement are small, but it is too loose, it is difficult to detect fraudulent transactions and control the unpaid rate, making it difficult to properly maintain service quality. Not only that, it may cause brand damage to merchants due to product resales.

Net Protections has a track record of over 20 years providing BNPL services in the Japanese e-commerce market, and by utilizing the data and credit know-how we have accumulated, we have succeeded in maintaining delinquency rates at a healthy level for business while achieving the approval rate over 97% of credit purchases.

With this sophisticated credit screening model as a weapon, we have supported various businesses to grow their sales.

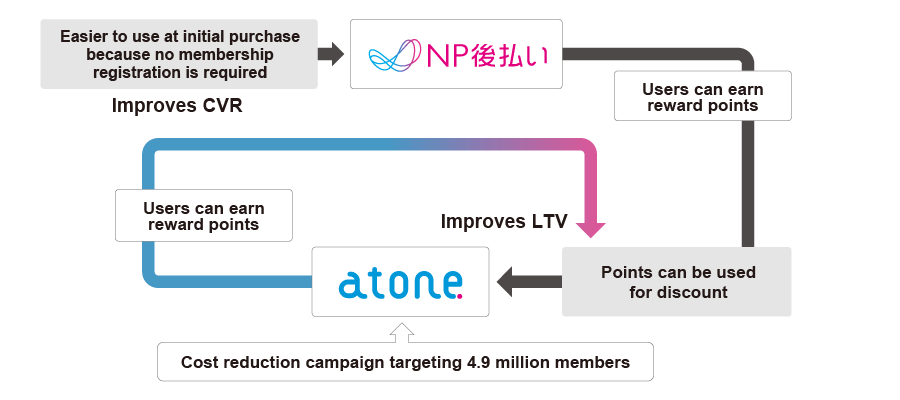

As the only BNPL payment service with a point reward program, merchants can not only increase CVR but also strengthen their LTV

NP Atobarai contributes to increasing CVR because it does not require any sign-up and can be used immediately. atone is another BNPL payment service that offers a unique membership point reward program and provides a UX optimized for smartphones, so it encourages repeat use, helping boost the repeat purchase rate for existing customers and strengthen LTV.

By offering both services, Merchants can both reduce new customers’ cart abandonment rate and promote existing customers to purchase repeatedly.

Limited-time introduction campaign for Shopify stores

About NP Atobarai

NP Atobarai is a BNPL (Buy Now Pay Later) service for BtoC e-commerce. As the first BNPL service in Japan, it has become the most used and trusted BNPL service in Japan. It yearly processes transactions over JPY 342 billion with more than 15.8 million unique users (*2). NP Atobarai provides BNPL with a simple & quick process, and no credit card information is required.

1 out of 7 Japanese reported that they have paid with NP Atobarai (*3). Customers find NP Atobarai easy and safe to use, especially with their first-time visiting online retailers because they can pay with confidence after the arrival of the order. Also, for NP Atobarai stores, merchants can satisfy demand for BNPL that takes up 20% of online shopping (*4) and expect sales increase while preventing risks.

For further information regarding NP Atobarai: https://www.netprotections.com (Japanese Only)

https://www.netprotections.com/

*2 The number of individual unique users of NP Atobarai based on the matching of duplicative names and phone numbers during FY2020 (April 1, 2020 to March 31, 2021).

*3 Based on “Preliminary Counts of Population of Japan” by Statistics Bureau of Japan (As of April 1, 2021) which estimated the number of individuals aged 15 years and older amounted to 110.5 million people in Japan and the number of NP Atobarai's annual unique users (15.8 million).

*4 Source: Company research.

About atone

atone is a cardless BNPL (Buy Now Pay Later) service well-known for its simplicity and clarity. With its unique point reward system, atone stores can reach 4.9 million non-credit card users (*5) and expect the increase of new customer acquisition, LTV, and repeat purchase rate. atone can be used in various fields such as e-commerce, digital content, and even physical stores. Customers can consolidate their orders into a single invoice in the month and pay in the following month. Also, 0.5% of the purchase is rewarded as NP points and can be used for discounts anytime. For the first-time users, it is possible to pay with atone immediately with a simple sign-up, and users can easily check the usage status and purchase history on the app.

https://atone.be/

*5 )Source: Company data (the number of the registered NP members as of September 2021)

Overview of Net Protections, Inc.

Net Protections, Inc. is a pioneer company in BNPL (Buy Now Pay Later) services in Japan and is leading the market with the largest market share (*6). In 2002, Net Protections launched its first service, NP Atobarai, a BNPL that guarantees risk-free transactions for businesses and provides a deferred payment for customers in Japan for the first time. In FY2020, NP Atobarai’s annual transaction volume has hit the growth rate of 116% compared to the previous fiscal year. NP Atobarai is used by numerous enterprises with over 15.8 million unique users in Japan (*7) and has processed more than 280 million transactions to date. In 2011, Net Protections released NP Kakebarai, a BNPL service for BtoB. NP Kakebarai has grown 127% yearly and played a role as the dominant BtoB payment service in Japan. In 2017, Net Protections launched atone, BtoC BNPL service with membership benefits that offers better shopping experience. In 2018, Net Protections released AFTEE, BtoC BNPL service in Taiwan.

Net Protections has accumulated transaction data and knowledge since its first service launched, which has enabled it to build a sophisticated credit screening system and solid operation skills. Net Protections always pursues creating a society where everyone can do business safely and easily.

【Company Name】

Net Protections, Inc.

【CEO】

Shin Shibata

【Website】

https://corp.netprotections.com/

【Business Outline】

BtoC e-commerce BNPL (Buy Now Pay Later) Service, NP Atobarai

BtoB BNPL Service, NP Kakebarai

BtoC BNPL Service, NP Atobarai air for individual day-to-day operations

BtoC BNPL Service with membership benefits, atone

BtoC BNPL Service in Taiwan, AFTEE

Point Reward System, NP Point Club

【Founded】

January, 2000

【Capital】

JPY 100 million

【Headquarter】

SUMITOMO FUDOSAN KOJIMACHI FIRST BUILDING 5F, 4-2-6 Kojimachi, Chiyoda-ku, Tokyo 102-0083 Japan

*6)Calculated based on the estimated size of BNPL market in Japan of JPY882 billion in FY2020 and the aggregate of GMV of NP Atobarai and atone in FY2020 of JPY360 billion. The estimated size of BNPL market in Japan is provided from Yano Research Institute “Online Payment/Settlement Service Providers 2021” *7 ) The number of individual unique users of NP Atobarai based on the matching of duplicative names and phone numbers during FY3/2021 (April 1, 2020 to March 31, 2021).

Direct any inquiries regarding this release to:

担当 :株式会社ネットプロテクションズ 広報

MAIL : pr@netprotections.co.jp