Net Protections, Inc. (headquartered in Chiyoda-ku, Tokyo; CEO: Shin Shibata; “Net Protections”) and the Shoko Chukin Bank, Ltd. (headquartered in Chuo-ku, Tokyo; President: Masahiro Sekine; “Shoko Chukin Bank”) have signed an agreement for a business alliance with the aim of supporting Shoko Chukin Bank’s corporate clients in solving their management issues by utilizing NP Kakebarai, a BtoB Buy Now Pay Later (BNPL) service offered by Net Protections. Under this agreement, Net Protections will begin NP Kakebarai business matching for Shoko Chukin Bank’s corporate clients.

Background and purpose of the partnership

Shoko Chukin Bank is a government-affiliated financial institution that was jointly established by the Japanese government and small- and medium-sized enterprise (SME) cooperatives with the objective of contributing to facilitating financing for SMEs. SMEs are faced with difficult financing challenges due to factors such as the COVID-19 pandemic and rising prices. Even under such adverse circumstances, Shoko Chukin Bank provides fundamental solutions tailored to solving clients’ issues by leveraging the financial know-how that it has cultivated for more than 80 years.

Shoko Chukin Bank aims to support the stabilization of SMEs’ cash flows and the promotion of their digital transformation, while NP Kakebarai supports the digital transformation of payment operations as a BtoB BNPL service.

Under this shared vision, the two sides have agreed to enter into a business alliance.

About NP Kakebarai

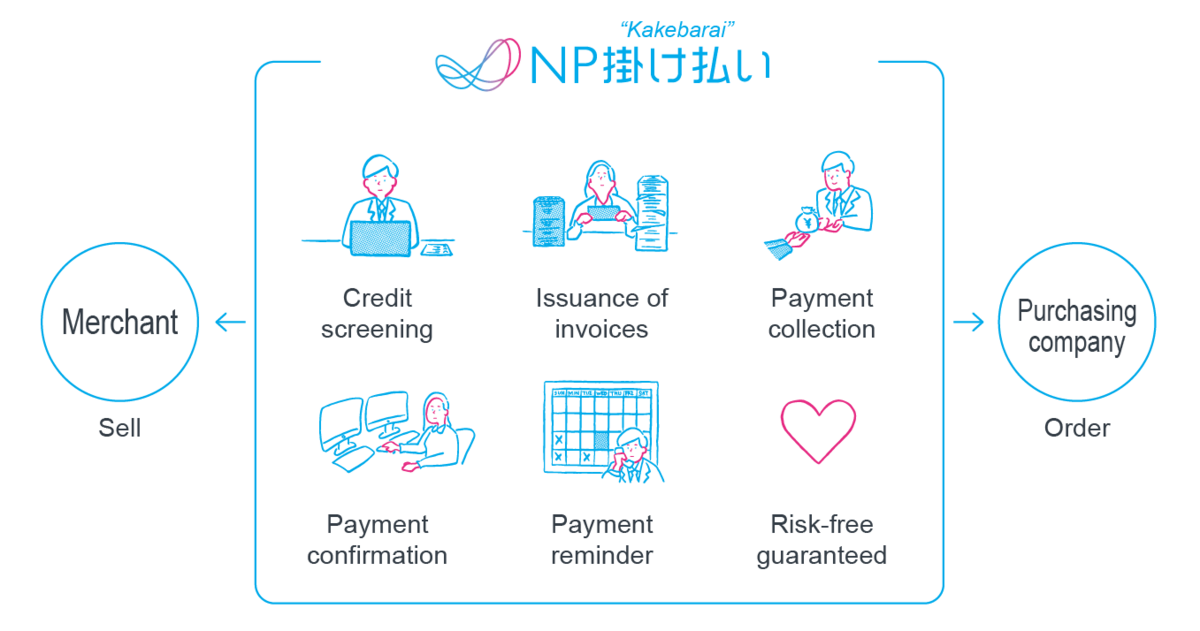

NP Kakebarai is a BtoB Buy Now Pay Later (BNPL) service that guarantees risk-free transactions and streamlines the complicated billing/payment process between merchants and customers through credit screening, billing, collection, payment confirmation, and payment reminders. With NP Kakebarai, businesses can outsource and digitally transform the whole billing process, thus it is able to reduce unnecessary operations and boost productivity. In addition, NP Kakebarai's sophisticated credit screening system which does not rely on the traditional Credit Bureau, accurately detects delinquency risk while maintaining 99% approval rate (※1), thus merchants can easily handle SMEs, even individual businesses while preventing risks. Therefore, it contributes to merchants’ sales increase and market expansion, also improvement of cash flow for clients for its flexible payment deadline. As of 2022, NP Kakebarai's annual transaction volume is JPY 97.9 billion, and 460,000 companies, or one out of every eight companies in Japan, use the service annually (※2). NP Kakebarai will continue to be dedicated to providing the service creating a sustainable environment in which all stakeholders can challenge and grow more freely.

For further information regarding NP Kakebarai: https://np-kakebarai.com/(Japanese only)

※1) As of March 31, 2022

※2) Based on “Report of the 2021 Basic Survey on Small and Medium-sized Enterprises” which estimated the number of Japan enterprise to 3.85 million and the number of companies using NP Kakebarai

About the Shoko Chukin Bank, Ltd.

[Company Name]

The Shoko Chukin Bank, Ltd.

[Representative]

Masahiro Sekine, President

[Website]

https://www.shokochukin.co.jp/english/

[Founded]

October 8, 1936

[Capital]

JPY 218.6 billion (including JPY 101.6 billion government subscription)

[Head Office]

2-10-17 Yaesu, Chuo-ku, Tokyo 104-0028, Japan

About Net Protections, Inc.

Net Protections, Inc. is a pioneer of Buy Now Pay Later (BNPL) services in Japan. In 2002, Net Protections launched its first service, NP Atobarai, a BNPL that guarantees risk-free transactions for businesses and provides a deferred payment for customers in Japan for the first time. NP Atobarai is used by numerous enterprises with over 15 million users (※3) and has surpassed 340 million transactions as of March, 2022. In 2011, Net Protections released NP Kakebarai, a BNPL service for BtoB. NP Kakebarai has grown 130% yearly and played a role as the dominant BtoB payment service in Japan. In 2017, Net Protections launched atone, BtoC BNPL service that can be used at not only e-commerce, but also digital content and physical retailers. In 2018, Net Protections released AFTEE, BtoC BNPL service in Taiwan. Net Protections has accumulated transaction data and knowledge since its first service launched, which has enabled it to build a sophisticated credit screening system and solid operation skills. Net Protections always pursues creating a society where everyone can do business safely and easily.

【Company Name】

Net Protections, Inc.

(Net Protections Holdings, Inc.[Code: 7383, Prime Market of Tokyo Stock Exchange] Group)

【Representative】

Shin Shibata, CEO

【Website】

https://corp.netprotections.com/en/

【Services】

BtoC e-commerce Buy Now Pay Later (BNPL) service, NP Atobarai

BtoB BNPL Service, NP Kakebarai

BtoC BNPL service for on-site services, NP Atobarai air

BtoC cardless BNPL service, atone

BtoC BNPL Service in Taiwan, AFTEE

Point reward program, NP Point Club

【Founded】

January, 2000

【Capital】

JPY 100 million

【Head Office】

SUMITOMO FUDOSAN KOJIMACHI FIRST BUILDING 5F, 4-2-6 Kojimachi, Chiyoda-ku, Tokyo 102-0083 Japan

※3)The number of individual unique users of NP Atobarai based on the matching of duplicative names and phone numbers between April 1, 2021 to March 31, 2022

Direct any inquiries regarding this release to:

Net Protections PR

Email: pr@netprotections.co.jp